Tag: SEC

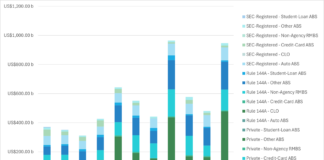

Insights & Analysis: SEC new datasets show 2024 was a boom...

New regulatory data published by the Securities and Exchange Commission’s (SEC) Division of Economic and Risk Analysis shows US asset-backed securities issuance almost doubling...

Declaration of dependence

US president to oversee financial institution regulation amid deregulation drive.

Executive orders signed by US president, Donald Trump, have given him oversight of all US...

Pumped up projections: The Arizona gym muni fraud

The SEC has filed charges against three Arizonian individuals, alleging they defrauded investors by falsifying revenue documents for a US$284 million municipal bond issuance...

FICC bolsters services for mandatory clearing

DTCC’s FICC has expanded its agency clearing services as volumes skyrocket ahead of the mandatory clearing deadline for US Treasuries.

The company is also providing...

Mandatory central clearing pushed back at SEC

The SEC has pushed back compulsory central clearing for US Treasuries by a year, stating the further attention to operational changes needed before the...

SEC: Leech charged with cherry picking trades for WAMCO funds

The SEC has charged Ken Leech with fraud. The bond trader was former co-chief investment officer at Western Asset Management (WAMCO), which holds US$336.1...

Rules & Ratings: Covered clearing agencies subject to new risk management...

The SEC has amended rules related to the risk management and resilience of covered clearing agencies, introducing new requirements around intraday margin collection and...

US vs Europe: The transatlantic divide for corporate bond traders

The DESK examines the different sizes, protocols and feedback traders can use on each side of the Atlantic to execute corporate bond orders.

While US...

Market Structure: New risk and liquidity in the US Treasury market

Significant changes in counterparties and market structure have transformed US Treasury market activity.

Dealer-to-client trading has overtaken interdealer markets in volume traded according to analyst...

A long way to go: “Fundamental concerns” raised around lack of...

With the US representing an estimated 46% of the global equity market, its upcoming shift to T+1 settlement in 2024 is a huge move....