Tag: SIFMA

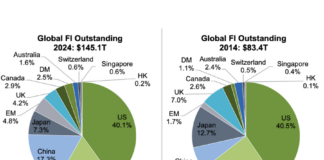

China takes a bigger slice of global FI pie

China has seen a growing share of global fixed income markets outstanding since 2014, with SIFMA data showing it to be one of the...

Rules & Ratings: Industry groups clash on NBFI leverage regulation

The Financial Stability Board (FSB) has been looking into risks around leverage in non-bank financial intermediation (NBFI) for a number of years. In 2023,...

Mandatory central clearing pushed back at SEC

The SEC has pushed back compulsory central clearing for US Treasuries by a year, stating the further attention to operational changes needed before the...

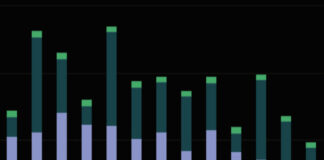

Money markets begin to tail off as rates fall

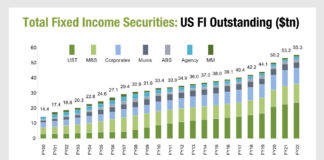

Reviewing the second quarter activity in primary markets and fund flows, we see the total notional outstanding in US fixed income totalled US$45.3 trillion,...

FILS USA: Policy, predictions and reasons for optimism

While outlooks are often gloomy, speakers at this year’s Fixed Income Leaders Summit were optimistic about the future of the industry. That said, the...

Debt, Outstanding!

The rising level of outstanding debt in the US markets is remarkable – it hit 144% of gross domestic product (GDP) in 2022 according...

Low issuance volumes may impact the momentum to reform primary markets

Platforms keen to emphasise longer term commitment to electronification and greater automation.

Multiple platforms have been launched to drive increased efficiency in managing bond issuance,...

The implication of falling US HY Issuance

Anecdotally, we hear that new issuance of high yield bonds in European markets directly impacted secondary market liquidity. Looking at the latest data from...

Tabb Group event: Concern regarding Reg ATS expansion

On 9 March the Tabb Group’s ‘Fixed Income Trading and Best Execution Summit’ heard that the Securities and Exchange Commission (SEC) concept release around...

SIFMA finds support for shift in benchmarking of 20-year US corporate...

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...