Tag: S&P Global Ratings

Ratings & Analysis: S&P predicts a strong 2026 for EM EMEA...

Insurance markets in emerging EMEA markets will remain strong in 2026, according to S&P Global Ratings predictions.

The creditworthiness of insurers in these markets, consisting...

Ratings & Analysis: S&P upgrades South Africa

S&P Global Ratings has upgraded South Africa’s long-term sovereign ratings, assigning the country BB for foreign currency and BB+ for local currency, with a...

Origination: Chevron issues US$5.5bn as revenue slumps

Chevron issued US$5.5 billion of notes in August after a disappointing second quarter.

The energy giant reported US$44.8 billion in revenues in Q2 2025, a...

Insights & Analysis: Weakened US economy and tariff uncertainty unsettles corporates

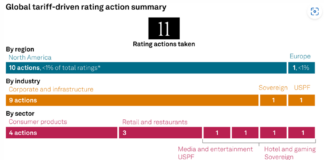

Trump’s long-dreaded and much-amended tariffs increased the US tariff rate to more than 18% this month – up more than eightfold on 2024’s levels....

Rules & Ratings: UnitedHealth Group credit outlooks downgraded to negative

AM Best has reassigned UnitedHealth Group’s credit ratings outlooks from stable to negative in anticipation of poor 2025 performance in its Medicare Advantage segment.

Similar...

Rules & Ratings: Ratings agencies spar in private ratings legitimacy debacle

KBRA has hit back at Fitch Ratings’ claims that private credit ratings are inaccurate, stating that the agency has damaged its reputation and integrity...

Rules & Ratings: S&P warns on forecast uncertainty

S&P Global Ratings has said it believes a high degree of unpredictability exists around policy implementation by the US administration and possible responses regarding...

The Book: HP prices US$1 billion in senior notes, prepares for...

HP Inc has priced US$1 billion aggregate principal in senior unsecured notes ahead of 25 April issuance.

Half the notes will be issued with 5.400%...

Origination: Mars issues US$26 billion to acquire Kellanova

Mars Inc has issued US$26 billion in senior notes in a private transaction to fund its acquisition of snacking company Kellanova, formerly Kellogg’s.

The offering...

Rules & Ratings: Italy in “strong position” to weather tariffs, S&P...

S&P Global Ratings has raised its unsolicited long-term foreign and local currency sovereign credit ratings for Italy to BBB+, with a stable outlook. Short-term...