Analysis of trading activity in the US corporate bond market shows that investment grade (IG) bonds are seeing greater moves towards larger order sizes than high yield (HY) bonds, according to analysis of TraX and TRACE activity data from MarketAxess.

Trade sizes for IG bonds tend to be significantly larger in size, because there is better issuer quality and a wider investment base, improving the natural level of liquidity.

Part of this stems from the natural buyers of IG debt, who are attracting large institutional investors including pension funds, insurance companies, and mutual funds looking for stable, long-duration fixed income instruments. Their scale based on assets under management demands larger block trades to get substantial exposure to low-risk assets.

In contrast, high yield bonds, which offer better returns at higher risk, often appeal more to hedge funds, private credit managers and retail investors willing to take the trade-off. These investors typically operate with smaller allocations and more tactical strategies, resulting in smaller trade sizes.

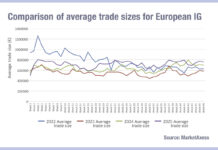

However the MarketAxess datasets indicates that beyond the disparity in order sizes, IG bond orders have a tendency to increase in size at points where trade count increase, when HY order do not.

For example, in March, May, September and October average TRACE volume for IG trading increased where trade count did not.

This can be tied to issuance. Investment grade issuers are generally larger corporations with frequent issuance and broader dealer coverage. This facilitates tighter bid-ask spreads and greater confidence in executing large trades without significant price impact.

In contrast, high yield bond issuers are often smaller and/or more leveraged, and their bonds are typically traded less frequently. Dealers are also more cautious about holding large inventories of HY bonds due to the higher risk of default, which impacts their cost of carry, in turn constraining market depth and limiting the viability of large trade sizes.

While both electronification and indexation of bond trading are facilitating liquidity transfer across IG and HY markets, this analysis is evidence that old fashioned market making through risk provision is still a key element in supporting dealer-to-client trading event in very sophisticated credit markets today.

©Markets Media Europe 2025