Analysis of US corporate bond market activity has found that trading volumes and counts plummeted going into the final month of the year. A fall at year-end is not unexpected due to a combination of regulatory pressures, dealer balance sheet management, and seasonal market behaviour.

In the market maker universe, banks particularly reduce risk exposure to meet capital requirements, and equally investment managers seeing lower primary market activity are likely to restrain risk taking as they position for the year ahead.

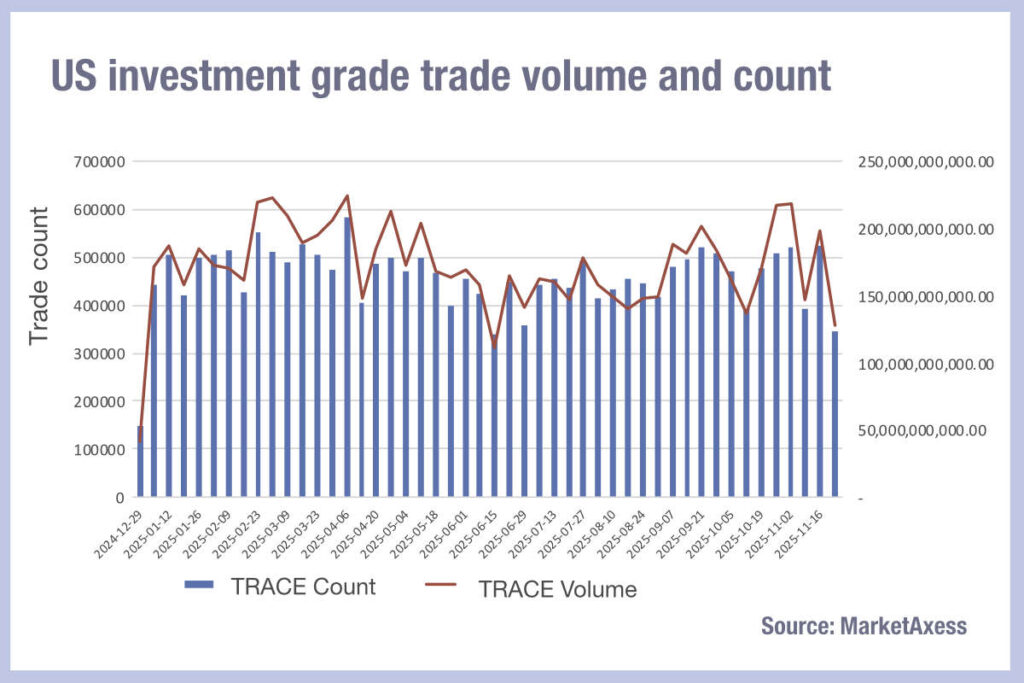

In the US investment grade (IG) market, weekly trade count for the final week of November was down 24% on the weekly average year to date, and trade volume was down 26% according to data from MarketAxess TraX, which follows activity across multiple markets.

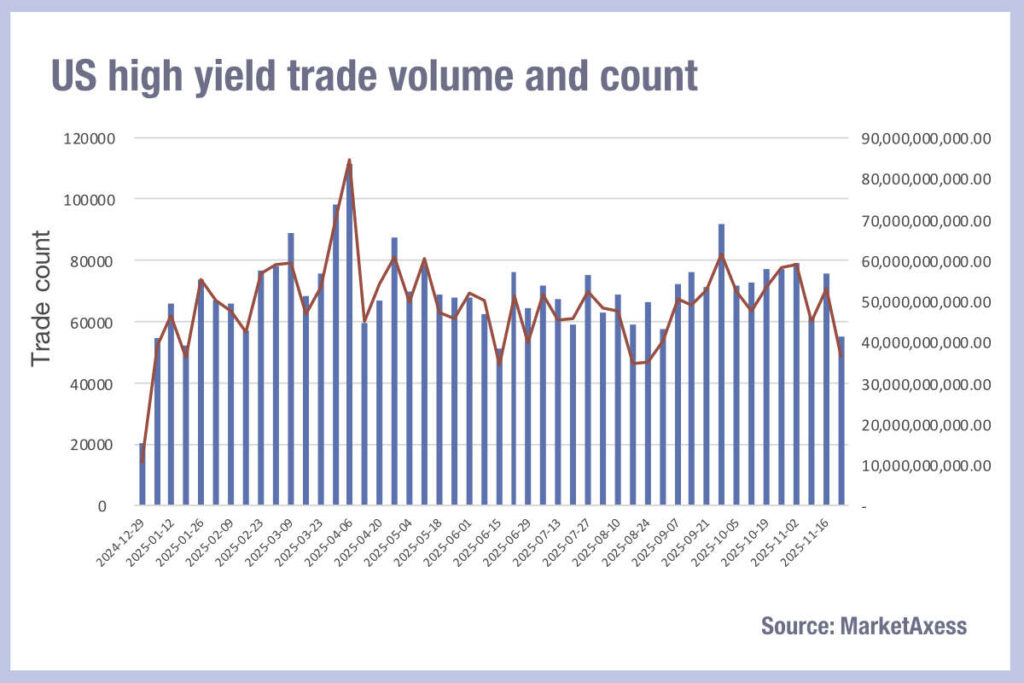

In the US high yield (HY) weekly market trade count is down 21% compared to the YTD average in the final week pf November, and trade volume down 26%.

The only week with a lower trade count / volume was the 16th June, for both grades of credit.

Although a temporary lull in activity is expected over the winter period, it typically lasts until markets reopen with renewed momentum in January.

There has been an expectation that increased electronic trading – and particularly electronic market making – had softened the impact in recent years, however the data indicates the seasonal dip remains a persistent feature of global bond markets.

For traders, understanding that electronic market making has not been a panacea for risk reduction is crucially important, just as it may well be that electronic trading provides access to better sources of liquidity during periods of low volume, whether that is by working orders in smaller chunks via all-to-all markets to find natural liquidity, or by using portfolio trading to fill complete orders with a range of counterparties.

Most importantly, tracking accurate data to understand actual market activity levels against expected levels is fundamental to understand any potential disruption to valuable liquidity.

©Markets Media Europe 2025