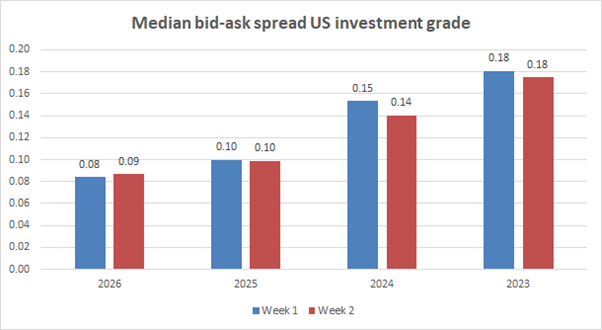

Credit markets have seen bid-ask spreads, a proxy for trading costs for the buy-side, tighten further in the first two weeks of 2026, relative down 50% on the spreads seen in 2023 for investment grade (IG) trading, according to MarketAxess’s CP+ pricing service. While the level of decline is plateauing to some extent, it is notable that the implicit costs of trading are still reducing while dealers are still making solid returns in FICC trading more broadly.

In US markets the average bid-ask spreads in IG have been sub 0.10 basis points (bps) for the first year on record, falling below half of that seen in 2023, and while this is only slightly lower than those seen in 2025, the fact that there is room for further compression is surprising in itself.

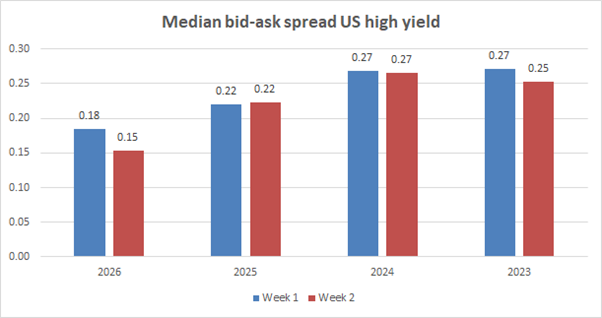

High yield trading has also seen bid-ask spreads tighten in US markets at the start of the year, albeit at a very different ratio. HY bid-ask spreads in the first two weeks of the year have declined by about 30% since 2023, in a less linear fashion than for IG.

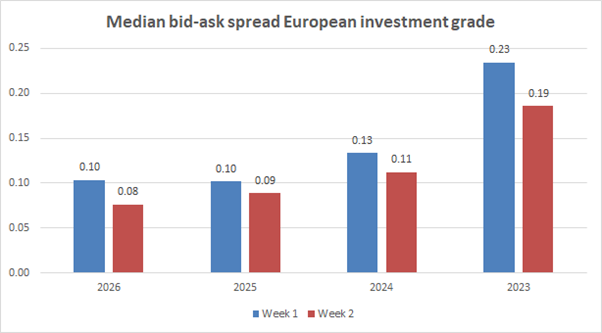

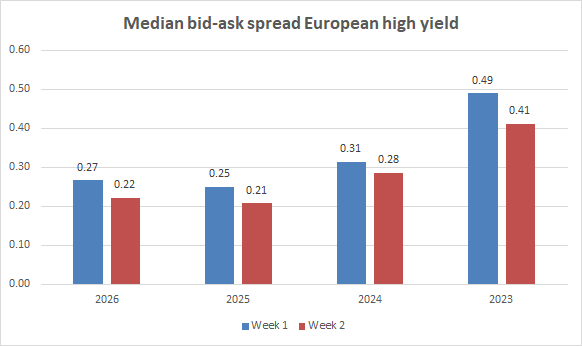

In European IG markets, bid-ask spreads are less than half the size they were in 2023, following a massive tightening in 2024, but have barely shifted since last year. The average bid-ask spreads for European HY have widened slightly vs the first two week on the previous four years.

The implication is that Europe appears plateaued in terms of its trading costs, where the US still has some way to go. The reason behind this might be the high number of brokers in Europe, which has already driven the costs of trading to a base level.

In the US, trading costs are still being driven down through a process of innovation in electronic trading, through adoption of all-to-all trading, portfolio trading, and extensive electronic market-making.

Despite the tightening costs, which represent tighter margins for market makers, major banks are still reporting increasing profitability for trading, and fixed income platforms continue to see growth in volumes.

Explicit trading costs are not the only way of measuring the trading costs. Reduced opportunity cost, due to wider availability of counterparties, and a reduced need to hold the least liquid parts of a portfolio have also reduced implicit trading costs. The most likely expectation will be that, as brokers consolidate or separate between those who make markets and those who do not, greater availability of quality trading data will enable more automated trading and tighter margins, continuing to drive down the cost of trading over 2026.

©Markets Media Europe 2025