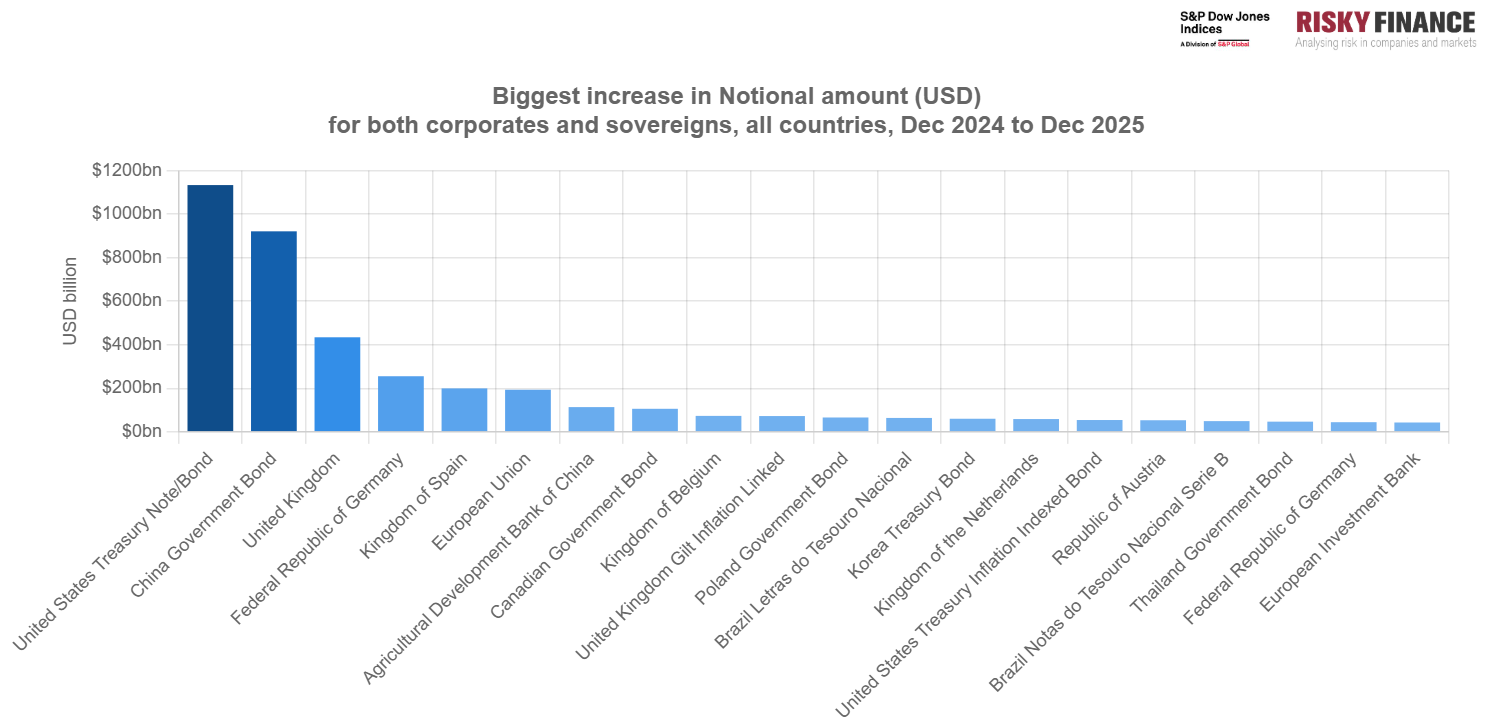

The European Union was the largest supranational issuer in 2025, with US$193.3 billion added to its debt pile over the year, largely driven by the conflict in Ukraine.

European institutions move into 2026 with big plans for more borrowing; Morgan Stanley analysts noted that the EIB had announced its estimated funding programme for 2026 at €60 billion with a borrowing authorisation of up to €65 billion, while KfW had announced it plans to issue ~€75-80 billion in 2026, slightly above the bank’s forecast.

However, SSA deals were dwarfed by government bond issues last year, with the US adding US$1.1 trillion to its debt pile, China adding US$921 billion and the UK adding US$434 billion.

KfW, rated AAA by Moody’s, Scope and S&P, with debt guaranteed by the Federal Republic of Germany mandated Barclays, BofA Securities, HSBC, and LBBW to lead manage its new Euro RegS Bearer long 3-year benchmark issue, maturing on 29 June 2029 and 10 year benchmark issue maturing on 4 January 2036, which closed today.

Total deal size was €10 billion, split five and five across the two deals, with total books in excess of €97 billion.

©Markets Media Europe 2025