Argentina’s bond markets have been notoriously challenging for investors. Twenty years after the country underwent a major debt restructuring, and just five years after it defaulted on a half billion US dollars of debt due to creditors, political uncertainty is again creating both risk and opportunity for long and short position holders.

The impact on trading patterns is also significant, driving bond traders on the buy-side and market makers to focus attention on liquidity access, for large and small trade sizes.

The Buenos Aires elections on 7 September were in favour of the Fuerza Patriaand against the party of the national government La Libertad Avanza, going against the polls. This suggests the Milei government – and therefore current economic policy – may face tough opposition in the 26 October midterm elections.

“These results appear to increase the probability of the central downside scenario in which the market questions the likelihood of continued reforms, and uncertainty rises around the future external financing sources,” wrote Morgan Stanley’s Fernando Sedano and Simon Waever on 8 September in a client note. “In this scenario we saw bonds down around 8 points from Friday’s close to a 56 average price with the front end underperforming. As also laid out, the market will likely factor in the potential for other downside scenarios.”

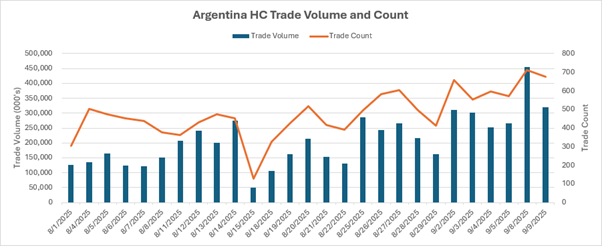

For traders, facing a more uncertain economic outlook, the Argentinian market has seen US$34 billion traded year to date, up 25%, with ARGENT being the number one emerging market hard currency ticker globally, according to MarketAxess data. While YTD average daily volume (ADV) has been US$195 million, volume the day after the election (8 September 2025) was US$456 million.

Notably, MarketAxess data indicates that trading jumped in size, indicating larger-sized risk positions were being taken, where normally the level of trading suggests that smaller sized trades are being delivered effectively.

Increased volatility suggests raised bond yields and wider credit spreads, with increased secondary market trading which should attract market makers and support investors.

“We close our suggestion added only last week to buy into the recent weakness despite what are likely to be much cheaper levels today, also removing our like stance,” noted Sedano and Waever. “As the credit curve flattens, we see the front-end bonds underperforming despite the much shorter duration due to the amortisations.”

The level of speculation driving flows between until the October polls are likely to necessitate different models of trading – from smaller to larger size – which in turn should direct the use of different trading protocols including all-to-all trading and directed request for quotes.so traders can respond to reactive market movements, with each poll or event potentially prompting rapid repositioning..

©Markets Media Europe 2025