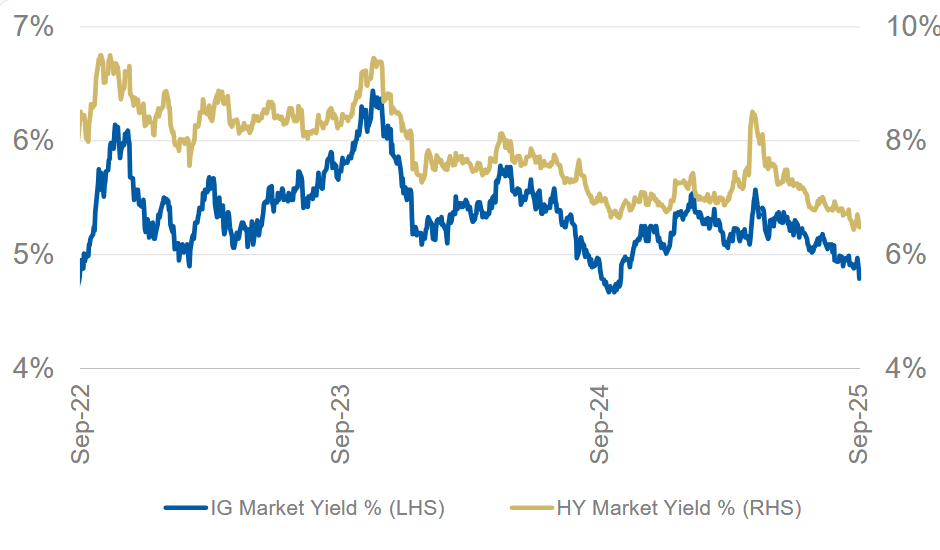

Analysis by Morgan Stanley’s team has found that, despite the slowing down of bond issuance globally in August, the higher levels of activity in July and September so far have provided enough activity to mark Q3 overall as a strong quarter based on new debt deals, as yields continued to fall for investors across investment grade and high yield.

“Aggregate August issuance declined 7% year-on-year (YoY) following a 41% increase in July, bringing quarter to date (QTD) issuance totals [up] 16%,” writes Toni Kaplan and Greg Parrish at Morgan Stanley. “While Q3 is off to a strong start, historically July and August combined account for ~55% of Q3 issuance with September being the most important month of the quarter.”

The higher levels of relative issuance in lower rated debt, including high yield and leveraged loans which YoY increased 45% and 104% for the month to the end of August, overtook investment grade which saw issuance drop by 25% YoY.

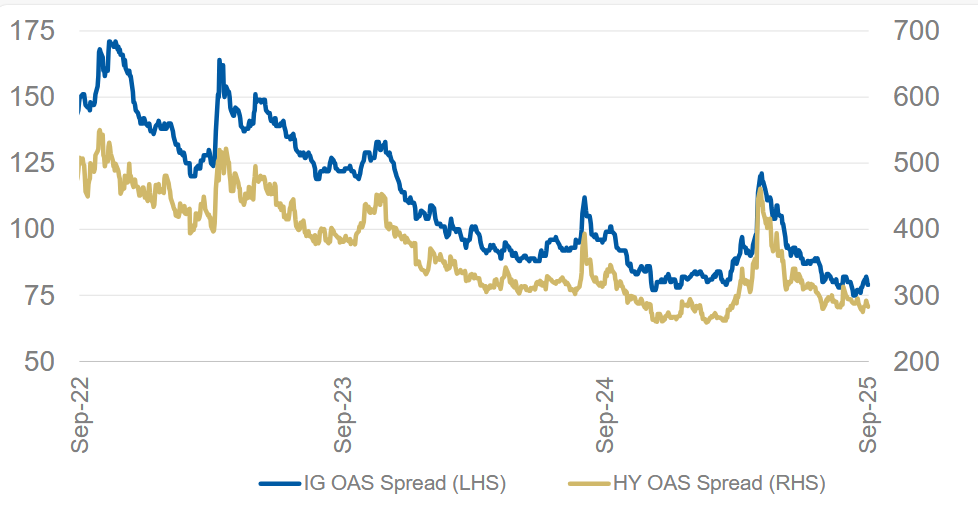

Spreads in IG have declined faster than in HY reducing the relative value gap between them.

“Total Corporate issuance declined -7% for the month,” they noted. “Structured issuance declined 6% as RMBS and CMBS were both soft in the month.”

©Markets Media Europe 2025