The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the UK’s female prime ministers; Margaret Thatcher, of whom Takaichi is an admirer, and Liz Truss, due to the risks of policy impacting funding via bond markets.

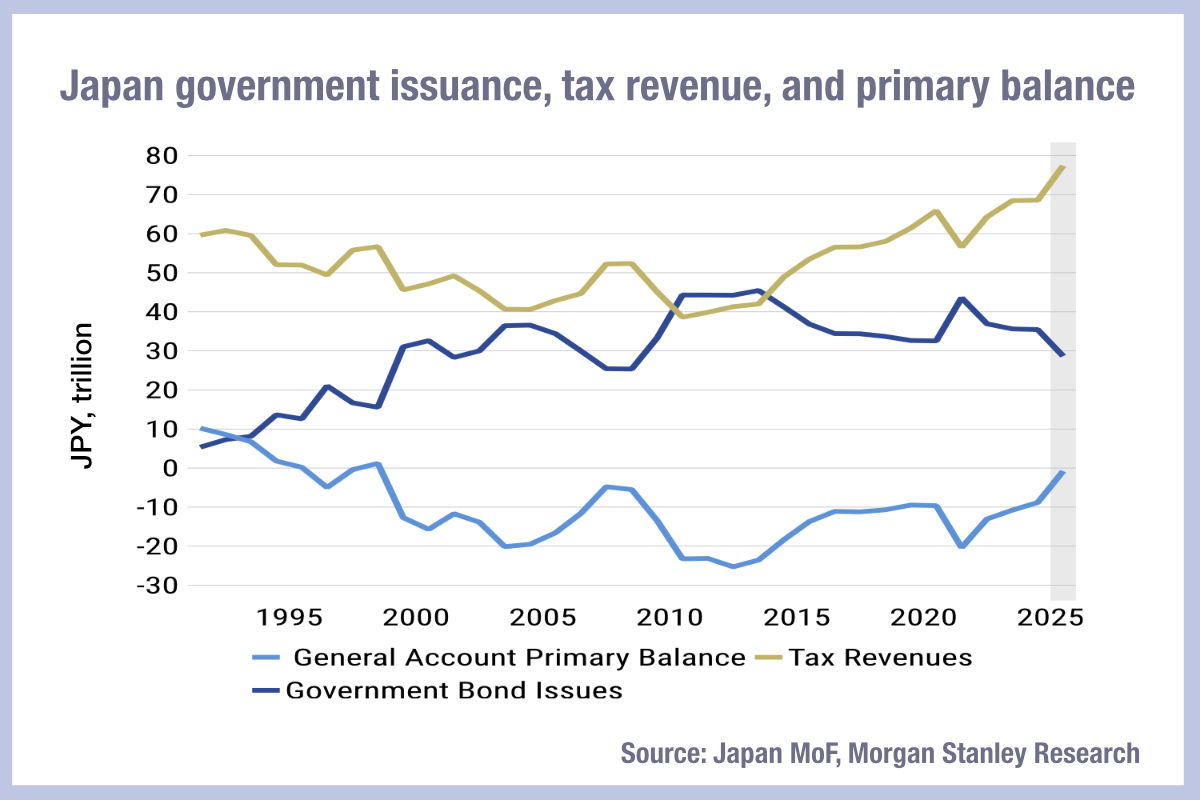

Consequently, investors are raising questions about Japanese government bond issuance, as a key aspect of the new Japanese administration’s stimulus spending and economic reforms. At the same time, buy-side traders are raising concerns about the capacity of the interdealer market to support liquidity at moments of duress.

“Late October is typically the time of year when discussions on an economic policy package, including a supplementary budget, begin to intensify. Strictly speaking, formulating a supplementary budget is not always necessary, but in recent years it has become something of a routine practice – almost a seasonal tradition in autumn,” write Hiromu Uezato and Koichi Sugisaki, analysts at Morgan Stanley MUFG Securities, writing ahead of Takaichi’s appointment.

Addressing concerns around issuance, they outline several misconceptions about funding programmes in Japan affecting Japanese Government Bond (JGB) issuance which may increase investor concern unnecessarily.

Firstly, economic stimulus packages are not fully funded by government bond issuance – the 2024 package having a little under 10% of funding via JGBs. The fiscal expenditure, national government expenditure and newly issued bond amounts (which captures non-‘JGB’ government debt instruments) are likewise not purely JGB-funded and includes local government funding and other sources.

“With the structural supply/demand imbalance in the super-long JGBs sector becoming increasingly evident, even if a large-scale economic package required additional market issuance, the Ministry of Finance (MoF) would likely respond by increasing issuance of short-to-medium-term bonds or T-bills, while considering reductions in super long-end issuance – and only after thorough dialogue with investors,” the analysts wrote.

At the recent Japan Electronic Trading Conference, organised by FIX Trading Community, held on 8 October 2025, the audience heard that secondary markets for JGBs has become increasing liquid through the enhancement of electronic trading models, facilitating the ability of the market to absorb supply more quickly.

Trading rooms are increasingly comprised of senior voice traders who use relationships to manage block orders, and more quantitative electronic dealers, with a which creates a barbell-effect for larger, manual trades and smaller electronic orders.

While a major key driver of electronification has been overseas investors, the advances have been adopted by the local market to better access liquidity.

Nevertheless, there are still some concerns around the interdealer market and its capacity to support liquidity during fast markets.

For the JGB market to compete effectively and efficiently, speakers said the adoption of electronics in the JGB interdealer market is imperative as its liquidity is still affected directly by futures and other more electronically traded markets.

Spot interdealer market liquidity and pricing is largely a manual process, so if futures move significantly, interdealer pricing struggles to keep up. If they cannot eliminate interest in the spot market, liquidity dries up resulting in a lack of pricing information for the rest of the market. This situation is similar to the March 2020 trading environment in US Treasuries, which saw a complete shutdown if trading for a period. Another market comparison might the stress on the UK government bond (Gilt) market under the Truss administration, when unfunded tax cuts triggered a massive sell-off in UK Gilts.

In Japan, this situation occurred most recently during the initial Trump import tax announcements in April 2025. Buy-side traders are therefore keen advocates for appropriate price formation in the interdealer market driven by advances in the electronification of interdealer markets.

However, the Morgan Stanley MUFG analysts remain confident that the outlook for issuance is unlikely to create excessive pressure on market capacity.

“In extreme terms, [their analysis] suggests that the government has a buffer of roughly the mid- JPY 30 trillion range,” they wrote. “Unless the total scale of additional bond issuance linked to the upcoming economic package reaches pandemic-era levels, it should be possible to avoid an increase in market JGB issuance. … [T]he anti-inflation measures proposed by Sanae Takaichi are not policies that require massive fiscal resources; a supplementary budget of several trillion yen would likely suffice.”

©Markets Media Europe 2025