Credit conditions are in the headlines following several private credit defaults, and the debt-fuelled, forward investment in data centres which are expected to underpin rapid expansion of an explosion in artificial intelligence use.

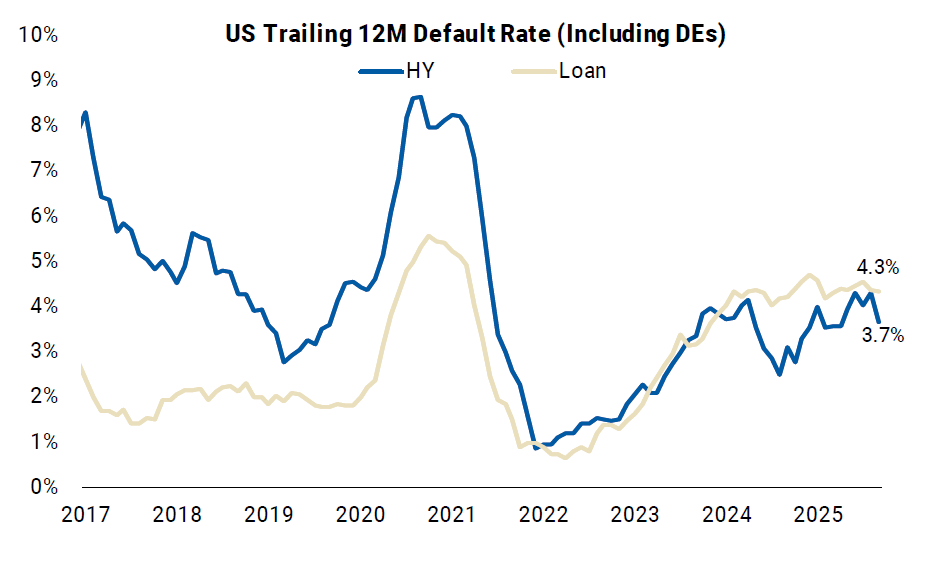

In public markets, there are few signs of worsening credit conditions in default data, based upon Morgan Stanley’s latest analysis. In US high yield (HY) the current default rate is 3.7%, and leveraged loans (LLs) are reaching 4.3%. While there has been an upward trend since 2022, that followed a collapse in default rates which had been far higher during the COVID crisis at around 8%, this still reflects relatively low levels looking back over the past eight years.

HY bonds are up a little on the past 12 months but are more recently in retreat, with a fairly tight range, and no clear direction over the past 18 months. Leveraged loan defaults are tilting up over 18 months but not at a significant rate.

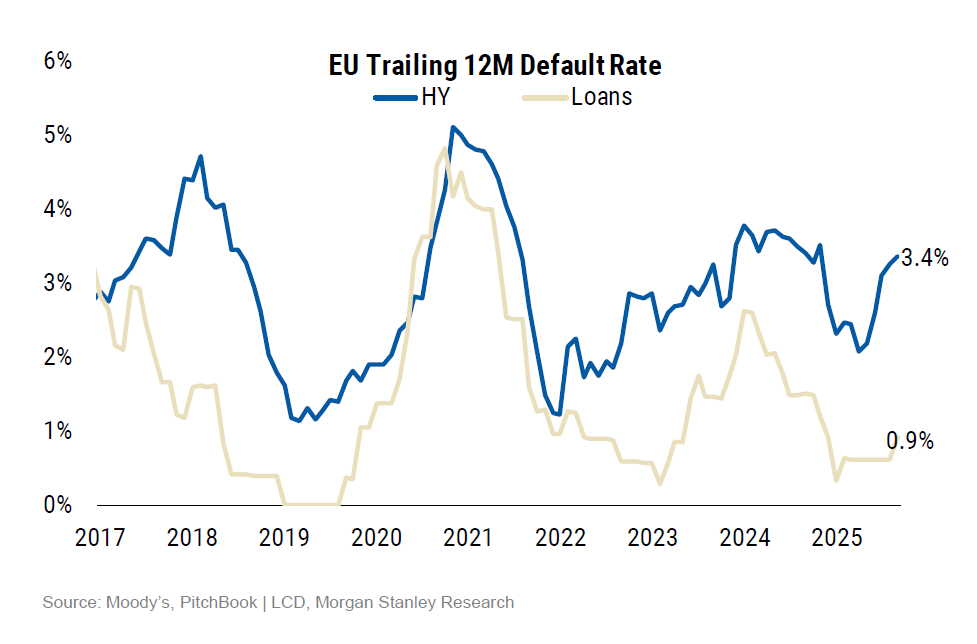

In Europe, HY defaults are at a 3.4% rate and loans at 0.9%, the former looking well within recent historical norms, the latter being low by most measures.

Firms with private lending portfolios see better returns from borrowers who are typically considered high yield/loan level debtors, enhanced by the specificity of borrowing conditions that support the increased potential risk that lenders face when going via private markets. However, they suffer from an illiquidity premium and the sector lacks the transparency that public markets offer.

Privately concerned

The surprise defaults of First Bands and Tricolor, who were private borrowers, raised the red flag on private credit this year, as has the subsequent revelations fo who was exposed to the debt, including Wall Street investment banks.

The initial headline shock has been dampened somewhat as details became clearer.

“The default cycle broadly has centred on bloated capital structures – in many cases 2021 LBO vintages – that were underwritten when rates were low, and are dealing with punitive funding costs,” wrote Morgan Stanley analysts. “Interestingly, defaults have been concentrated in non-cyclical sectors such as Telecom, Healthcare, and Consumer Staples. In the case of First Brands though, challenges emerged around double-pledging of collateral and invoice factoring, which first created concerns around the quality of earnings/refinancing. In our view, this (First Brands) is very much a case of company-specific challenges, as opposed to representing a broad-based weakening in underwriting standards or operating performance.”

With trading in private credit largely supported by private loans’ inclusion within collateralised loan obligations (CLOs) which are somewhat more standardised and fungible than individual private debt agreements, buy-side traders will have limited recourse to step away from private debt portfolios if risk metrics change adversely.

Public doubt

There are also signs that concern in public markets is mounting. Alarm bells are ringing about debt-fuelled investment in technology infrastructure to support ‘artificial intelligence’ development.

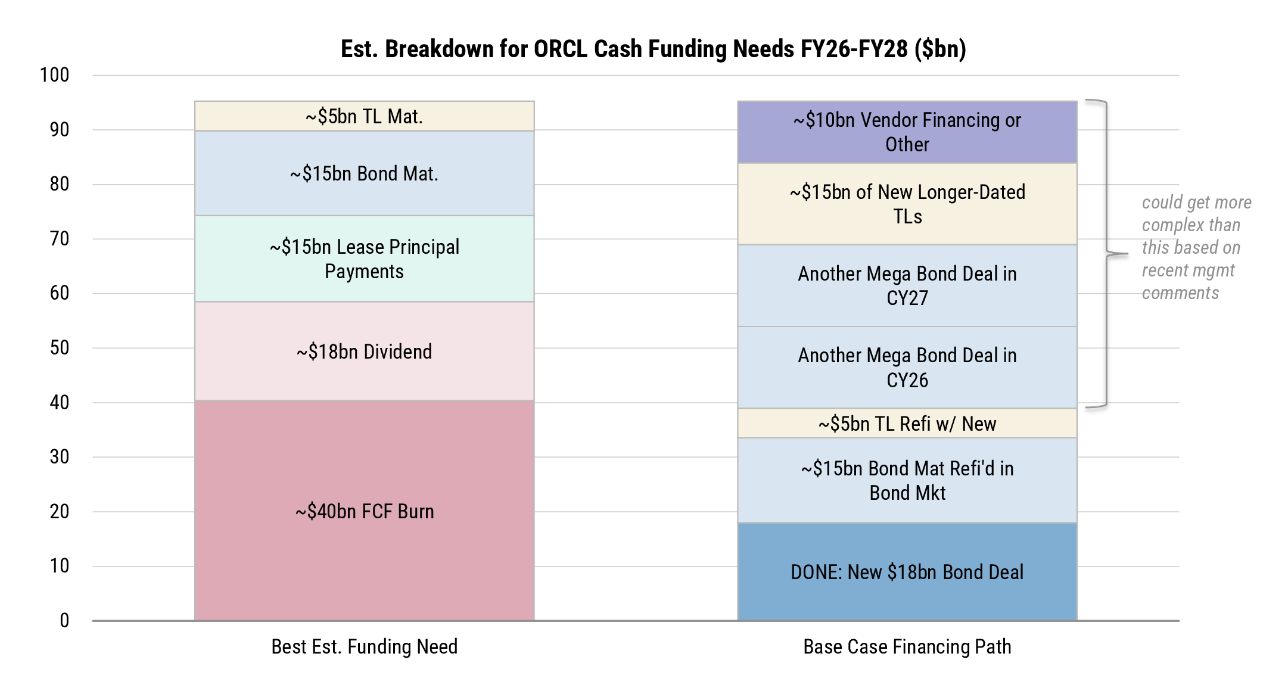

Exemplary is Oracle’s US$18 billion bond issue in September 2025 which is estimated by Morgan Stanley to have only covered around 20% of the firm’s funding needs to support data centre investment to the end of 2028. These data centres are posited as key to supporting the development of smarter systems, including machine learning and so-called ‘artificial intelligence’ offerings which are predominantly pattern spotting and prediction tools.

Credit spreads for Oracle in single name credit default swaps (CDS) blew out in October as the AI ‘bubble’ that many investors perceive to be growing began to be reflected in concern around credit risk.

“Oracle’s new bond issuance follows management calling its data centre financing approach ‘asset pretty light’ on the full year Q1 2026 call, and will help to cover a portion of [the] ~US$95bn estimated cash funding needs through end-FY28,” wrote Lindsay Tyler, David Hamburger and Kyle Yellin of Morgan Stanley’s credit analyst team on 28 September 2025.

Their recommendation to buy the five-year CDS at +57bp the Oracle 4.45% bond at +71bp was based on a cautious approach to the growth model, and gives buy-side traders an idea of how they might approach supporting portfolio manager’s view of risk exposure.

“We think credit deterioration, driven by cash funding needs and lease liabilities, could drive a Moody’s downgrade, and drive bondholder and lender CDS hedging,” they wrote. “Meanwhile, we think there is technical support for Oracle cash, given limited other opportunities to step in on the emerging AI data centre thematic investment opportunity in public IG new issues.”

©Markets Media Europe 2025