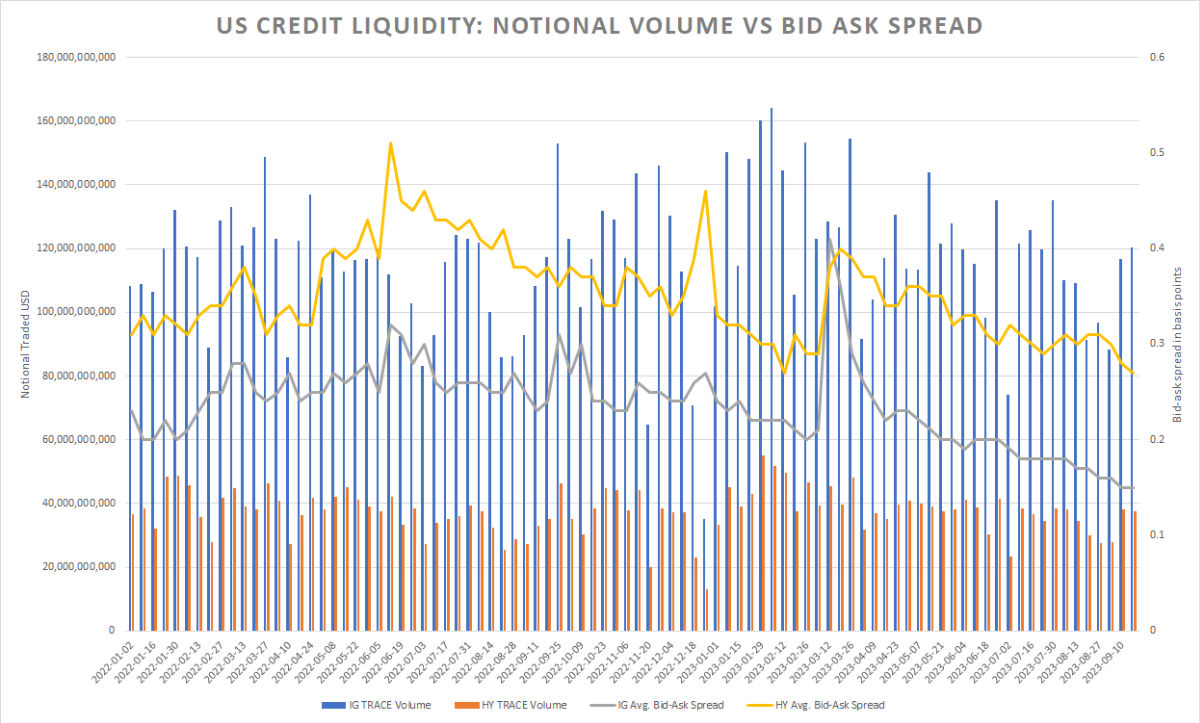

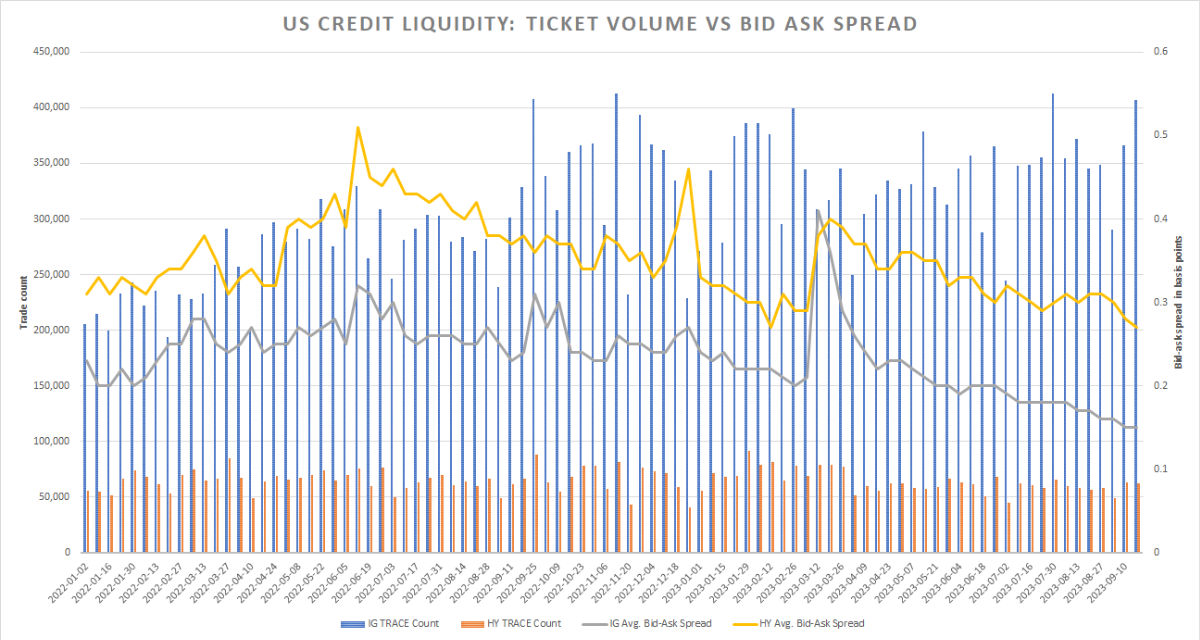

Liquidity in US credit has improved significantly over the past year, with bid-ask spreads lower than any point in 2022, according to MarketAxess’s CP+ data, and the trade count for investment grade (IG) on TRACE has sustained relatively high volumes, as captured by MarketAxess’s Trax, which measures activity across multiple fixed income markets and sources. The trade count for high yield (HY) is more static.

Setting bid-ask spreads against notional volume, also using MarketAxess’s CP+ and Trax data, we see a gradual decline in value traded – in contrast to ticket numbers – and the spread for both HY and IG seems to be declining relative to IG notional traded, despite HY notional showing a flatter trend overall.

What does this imply? US credit traders have never had it so good. Easier to trade smaller tickets are flourishing – based on the higher trade count relative to the value being traded – and the cost of liquidity has been falling.

This also implies that electronic trading, which Coalition Greenwich recently observed is supplementing the demand for capital-intensive risk trading, is becoming easier to engage with, trading in smaller sized tickets and thereby freeing up time for buy-side traders.

Net-net, trading desks in the credit space can potentially deliver better execution outcomes for their end investors, through judicious application of e-trading.

©Markets Media Europe 2023