Inflation levels could have a direct impact on volume of work – and therefore operational pressure – on buy-side trading desks.

Managing the process of new bond issues is still frustratingly manual and despite the development of several technology platforms to electronify the process, the lack of a standard interface limits the efficiency gains of employing these tools, as switching between them is itself a manual task. Traders cannot add much value to primary market activity, where they add considerable value to secondary market activity. If bond issuance is maintained or increases this year that will make life for buy-side traders harder.

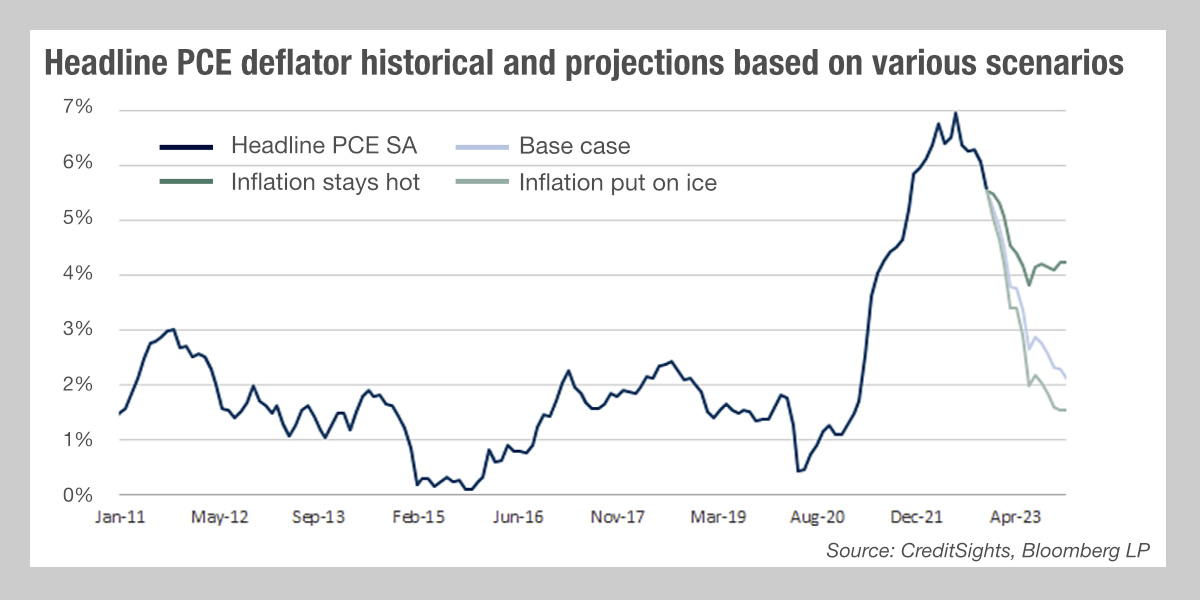

US inflation is predicted to fall later in 2023, with disagreement on the impact this will have on the Federal Reserve Bank of New York’s fund rate. Analyst firm CreditSights predicts the size of interest rate increases by the US Federal Reserve Bank will be more limited, than that expected by the wider market. This potentially has a major impact on bond issuance in 2023.

Debt has been supporting businesses at low rates for over a decade. While concern around a recession and reduced spending is impacting business, outside of lower rated debt there is the potential for businesses to continue to service debt at what are still relatively low levels of cost compared with historical highs.

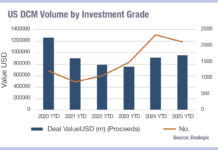

Despite the higher rates being paid on new bonds issued in Q1 2023 relative to previous years, there has been record levels of bond issuance. If debt issuance is being supported at a time of rising rates, what will happen if inflation falls?

Looking at the CreditSights analysis, it sees several potential scenarios playing out. If inflation remains high, the measure of inflation in US markets, PCE, could remain at 4.3% by December 2023. The firms believe this could see spreads in investment grade credit widening to 200 basis point (bps) and to 700 bps in high yield (HY) by the end of the year. That could certainly impact the affordability of debt issuance and refinancing.

In the scenario in which inflation is effectively dealt with, the firm believes PCE could drop below 2% by the end of 2023, hitting 1.5% by December.

CreditSights estimates that the Fed funds rate – currently 4.25-4.5% – will peak at 4.5-4.75%, while the wider market estimates it will peak at over 5%. While the firm’s estimates of spreads on credit in the high inflation scenario could reduce bond issuance, if that does not transpire, buy-side desks may struggle to handle the volume of work needed this year in primary markets.

©Markets Media Europe 2025