BLOOMBERG: Supporting diversity and inclusion in trading

The firms who are part of this Bloomberg initiative discuss how it is benefitting investors and scoring goals in the governance space.

The DESK spoke...

BondCliQ’s new portfolio trade reporting changes understanding of volumes and counterparties

Market data solutions provider, BondCliQ, will be launching a dynamic weekly report which aggregates and analyses data on US portfolio trading (PT) from TRACE,...

Game Changer: Liquidnet

Markets Media's Traders Magazine spoke with Mark Govoni, CEO of Liquidnet, which won Game Changer at the 2023 Markets Choice Awards.

How does your company...

Beyond Liquidity: Rebundling Research Will Not Increase Demand for UK SMEs

With the implementation of MiFID II in 2018 came the unbundling of payments for investment research from trading commissions. The perceived benefit of unbundling...

Regulation Brings TradFi and DeFi Worlds Together

The European Union passed a legal framework for crypto-assets in the region in April this year, covering markets that are not regulated by existing...

Beyond Liquidity: Investors Turn to Fixed Income Dark Trading During Market Stress

Dark pool trading in credit markets offers numerous benefits on a day-to-day basis, and can increase during periods of market stress. A recent example...

Trumid: Portfolio trading comes of age

For an institutional investment manager that needs to add or reduce risk in its corporate bond portfolio, being able to trade a custom basket...

Viewpoint: Lifting the pre-trade curtain

Michael Richter, an executive director at S&P Global Market Intelligence, and head of the Transaction Cost Analysis (TCA) business for EMEA explains the key...

Trading Intentions 2023 Profile: Neptune

Neptune proves the standalone choice

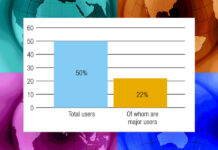

Neptune is the most used standalone pre-trade data source in credit markets, with half of desks employing its streaming axe...

The liquidity gap between 144A and Reg S bonds

144A and Regulation S (Reg S) securities have distinct regulatory backgrounds and key differences. Liquidity measures such as Bid-Ask spread and post-issuance volumes in...