Propellant.digital reports rapid uptake of its bond data analytics

Vincent Grandjean, CEO of analytics software provider Propellant.digital, is pleased with the firm’s progress to date.

“We are live with clients and bearing in mind...

Concannon to take the reins at MarketAxess

Market operator, MarketAxess, will see current CEO and chairman Rick McVey become executive chairman from 3 April 2023 as Chris Concannon, currently president and...

FILS 2022 Debate: Win for the sell-side status quo but Poole’s analogy skills abound

One of the most entertaining sessions at the Fixed Income Leaders Summit in Nice last week was a debate with a serious point. Discussing...

William Dulude joins Clear Street, plus new management appointments

Clear Street, the prime broker and capital markets infrastructure provider has named William Dulude as chief product officer; Prerak Sanghvi as vice president of...

Parameta and PeerNova launch ClearConsensus price valuation for OTC derivatives

Parameta Solutions, the data and analytics division of TP ICAP Group, has partnered with PeerNova, a Silicon Valley data analytics and management company, to...

ION expands further with Clarus Financial Technology acquisition

ION Markets, the trading, analytics, and risk management solution provider for capital markets, has bought Clarus Financial Technology, a provider of SaaS analytics, data,...

Parameta Solutions launches post-trade analytics platform for bonds

Parameta Solutions, the brand of TP ICAP’s Data & Analytics division, has launched a global post-trade analytics platform, Trading Analytics. The new offering is...

CME Group ADV up 32% year-on-year for October

Market and infrastructure operator CME Group, has reported its October 2021 market statistics, showing average daily volume (ADV) increased 32 percent to 20.4 million...

US inflation hits its highest level in three decades

Jonathan Baltora, head of sovereign, inflation and FX at AXA Investment Managers says, “US inflation rising by 0.9% in just one month brings it...

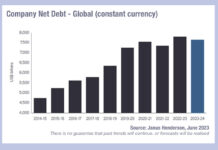

Issuance pushes outstanding global debt up 6.2%

Companies around the world took on US$456 billion of net new debt in 2022/23, as of 31 March 2023, pushing the outstanding total up...