Coalition Greenwich: Asian bond markets see electronic trading adoption accelerate

New analysis by research firm Coalition Greenwich has found that, while much of the e-trading growth in Asia to date has come via relatively...

Update: How big is portfolio trading?

In November 2020, we assessed the prevailing research on the size of portfolio trading in the corporate bond market. A new report from Coalition...

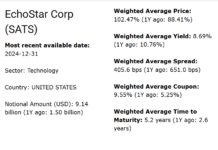

Origination: Issuer profile – EchoStar Corp

EchoStar Corp saw the largest proportional increase in notional debt outstanding in the technology sector in 2024, with a 509% increase, taking it to...

Tabb Group event: Concern regarding Reg ATS expansion

On 9 March the Tabb Group’s ‘Fixed Income Trading and Best Execution Summit’ heard that the Securities and Exchange Commission (SEC) concept release around...

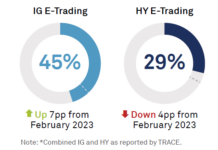

Coalition Greenwich: Electronic bond trading rises in US IG, declines in high yield

The use of electronic trading in corporate bonds will continue to increase, Coalition Greenwich’s March Data Spotlight has stated.

Electronic trading activity grew faster than...

Coalition Greenwich: 0% impact of ESG on bond trade execution – but is there...

According to new research from Coalition Greenwich, 0% of US-based buy-side bond traders report that environmental, social and governance (ESG) impacted their choice of...

Coalition Greenwich’s deep dive into fixed income TCA

A report by analyst firm Coalition Greenwich has set out the tough but potentially rewarding path for increased adoption of transaction cost analysis in...

Katana launches on Bloomberg

Katana, the pre-trade analytics tool that helps to identify relative value opportunities for bond market dealers and asset managers, is live on the Bloomberg...

LatAm sees e-trading momentum with support for all-to-all

In Latin America, 46% of trading in corporate hard currency bonds is conducted electronically, according to research by analyst firm Coalition Greenwich, compared to...

Greenwich: Treasuries volatility ‘crazy’ low compared to 2019

Analysis by research firm Greenwich Associates has found the US Treasury market saw volatility 50% lower in August 2020 than in August 2019, which...