Nick Garrow joins Trading Technologies as EVP multi-asset and buy side

Trading software, infrastructure and data solutions provider, Trading Technologies International, has hired London-based industry veteran Nick Garrow in the new position of EVP multi-asset...

valantic FSA invests in low-code technology provider Velox

valantic Financial Services Automation (FSA), a provider of cross-asset electronic trading and automation solutions, has completed an investment in Velox Financial Technology, to support...

MarketAxess: New trading protocols are expanding, not cannibalising, liquidity

MarketAxess has reported its second highest level of quarterly revenue and credit trading volume, as well as a record total trading volume in Q1...

Wave Labs launches Systematic Investment Application for building systematic credit strategies

Execution management system (EMS) provider, Wave Labs, is launching its Systematic Investment Application (SIA), a new modular system for developing systematic strategies in the...

Bloomberg warns on SEC extending exchange rules into bond market communication protocols

In a letter penned by Bloomberg’s Gregory Babyak, global head of regulatory Affairs and Gary Stone regulatory analyst and market structure strategist, the market...

Bloomberg and MSCI launch Paris-Aligned bond indices

Bloomberg and MSCI have launched indices in their joint Climate Benchmark offering with the Bloomberg MSCI Global, Euro and US Corporate Paris-Aligned Indices. These...

Peter Metcalfe and David Matheson named co-CIOs at RPIA

RPIA, a Toronto-based fixed income specialist asset management firm has appointed Peter Metcalfe and David Matheson as co-chief investment officers (CIOs), effective 1 June,...

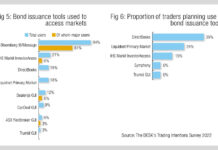

Will primary market tools fragment new issuance instead of standardising it?

Research by The DESK has found that buy-side traders have adopted a range of primary market tools to help them increase their efficiency at...

Tradeweb sees credit default swap volume double in March

Tradeweb has reported total trading volume for March 2022 of US$28.2 trillion, with US$811 billion in credit default swaps, up from US$330 billion in...

Tradeweb launches AI pricing service for munis

Market operator Tradeweb has launched a new service, Tradeweb Ai-Price, which uses machine learning and proprietary data science to calculate daily prices for municipal...