ICE connects to Adroit’s EMS

Intercontinental Exchange (ICE), the data, technology and market infrastructure provider, has connected ICE Bonds with Adroit Trading Technologies, the provider of order and execution...

Wells Fargo Asset Management becomes Allspring Global Investments

Allspring Global Investments has officially commenced operations as an independent asset management firm, as a US-based manager with US$587 billion assets under management (AUM)....

CME Group ADV up 32% year-on-year for October

Market and infrastructure operator CME Group, has reported its October 2021 market statistics, showing average daily volume (ADV) increased 32 percent to 20.4 million...

E-trading bond platforms outperform banks’ Q3 in fixed income trading

Market operator Tradeweb has seen a strong Q3 revenue against the same quarter in 2020, while electronic bond-trading MarketAxess has seen a slight decrease...

Invesco joins Glimpse Markets as new membership continues to grow

Asset management giant Invesco has become the latest firm to join Glimpse Markets, the data sharing service for investment managers, banks, brokers and market...

Lack of detail sinks odd-lot bond case against major banks

The United States District Court, Southern District of New York, has dismissed a court case brought against Bank of America, Barclays, Citigroup, Credit...

Sidi Shatku poached by BofA

SMBC’s former head of Emerging Markets (EM) Credit Trading in Europe, Middle East and Africa (EMEA), Sidi Shatku, has joined BofA’s EM credit trading...

SETL open sources its code with new PORTL solution

SETL, the blockchain company, is open sourcing its core framework, PORTL, which it intends to speed up adoption of blockchain and distributed ledger technology...

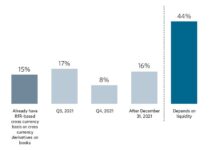

Bloomberg/PRMIA report finds liquidity barrier to RFR derivatives use

A new report by the Professional Risk Managers' International Association (PRMIA) and Bloomberg has found that while the majority (79%) of the firms with...

CME reports record SOFR futures volume and open interest

Market operator and infrastructure provider, CME Group, has reported that a record 396,421 SOFR futures contracts were traded on 18 October 2021, surpassing the...