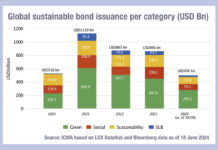

Sustainable bond issuance now 12% of total market

A report co-authored by Nicholas Pfaff, Valérie Guillaumin, Simone Utermarck, Ozgur Altun and Stanislav Egorov of the International Capital Markets Association (ICMA), has found...

Tradeweb saw ADV hit US$1 trillion in January 2021

Market operator Tradeweb has reported its total trading volume for January was US$20 trillion across its electronic marketplaces for rates, credit, equities and money...

Bondecosystem and TransFICC partner for bond market connectivity

Outsourced connectivity specialist Bondecosystem has partnered with financial technology provider TransFICC, to deliver a low-latency execution and connectivity service to electronic fixed income venues.

The...

NatWest, Santander with Fnality, Nivaura and Adhara execute cross-chain Ethereum debt transaction

Three UK financial technology firms, Fnality, Nivaura and Adhara, in collaboration with European banks Santander and NatWest have completed a pilot, proof of concept...

FILS 2021: Boosting liquidity through market structure

The rise in bilateral streaming and the regulatory push towards central clearing can increase the diversity of trading counterparties and boost liquidity according to...

Aité: Buy-side desk sophistication is driving EMS innovation

A new report by analyst firm Aité, entitled, ‘OMS/EMS Convergence in the Cloud: Better Together’, author Spencer Mindlin has identified two major trends in...

ION Markets delivers trading connectivity for Trumid

ION Markets, a provider of trading solutions for capital markets, has upgraded its connectivity to support market operator Trumid’s Attributed Trading, a disclosed dealer-to-client...

Origin launches Instant-ISIN 2.0 for Eurobond issuance

Origin, a debt capital markets fintech, has launched Instant-ISIN 2.0 for both allocation and activation of ISINs for Eurobond issuance, ‘XS’ ISINs, while also...

Potential SEC pilot programmes explored by new bond committee

The Securities and Exchange Commission’s Fixed Income Market Structure Advisory Committee (FIMSAC) explored the possibility of prescriptive intervention to accelerate bond market structure and...

Digital Asset’s new markets blockchain backed by CBOE, Deutsche Börse and ASX

Digital Asset and a group of capital market participants plan to launch the Canton Network, a ‘privacy-enabled’ interoperable blockchain network designed for institutional assets....