Competition in US Treasury clearing could sustain vicious exchange battle

The bitter competition between FMX and the CME, for trading of US Treasuries and Treasury futures, could enter an accelerated phase as new clearing...

Scottish ‘vanity’ issuance project puts investors at risk from independence

The Scottish Government has confirmed plans to enter the bond market and issue £1.5bn of debt in 2026-2027.

Ben Ashby, chief investment officer at...

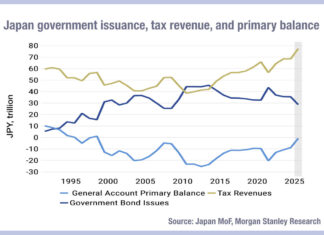

Analysing concern around Japan’s government bond issuance and interdealer inefficiency

The appointment of Liberal Democratic Party (LDP) leader Sanae Takaichi as the country’s first female prime minister has drawn comparisons with two of the...

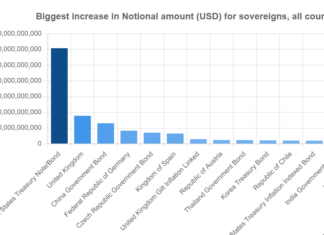

The de-dollarisation debate

Investors see their short duration positions getting longer this year, with a shift to EM debt, and a multi-decade case for de-dollarisation, attendees at...

Fund managers report more certainty in EM than in developed markets

The key takeaway from the first plenary session at the Fixed Income Leaders Summit in Amsterdam was clear; in 2026, uncertainty has become a...

Traders welcome India’s bond e-trading evolution as regulator shows teeth

The Indian bond market provides a conundrum for investment traders, who fight to gain access to liquidity and pricing information on behalf of their...

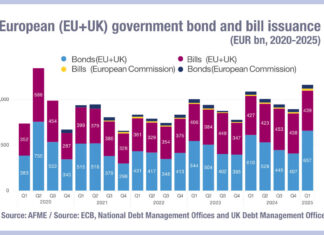

Origination: Will Germany support European debt mutualisation?

UBS Asset Management’s Jonathan Gregory, head of UK fixed income, has posited the idea that European countries may at some point seek to mutualise...

European govies issued at record level in Q1

This year saw the highest first-quarter European government bonds and bills issuance volume since 2006 as €1.2 trillion was issued in Q1 2025, according...

Treasury futures fight intensifies between FMX and CME

The US Fixed Income Leaders Summit 2025 showcased the fierce rivalry in the US treasury futures space, between incumbent giant exchange CME and upstart...

Origination: Government bond supply next week

Nominal supply of bonds scheduled in the Euro area next week is expected to level at €17.8 billion of European government bonds (EGBs), according...