Seth Bernstein: Diversification via fixed income “if not dead, is in...

Seth Bernstein, the CEO of US$622 billion AUM asset manager AllianceBernstein, has opened the Fixed Income Leaders’ Summit US today, with an analysis of...

How traders weathered the Treasury sell-off

The US Treasury’s auction of seven-year notes last Thursday saw the lowest investor appetite ever, according to some sources, leaving primary dealers holding the...

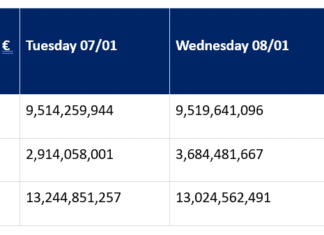

Gilt activity spikes as new rates reality bites government borrowers

By Dan Barnes and Etienne Mercuriali

Gilts market opening on the morning of 9 January suggested some traders took a big hit, with stop losses...

Chappell lands new trading role for 2020

Brett Chappell, the former head of fixed income trading at Nordea Investment Management, is joining Mariana UFP, a global financial services business in London...

Rates : Fully automatic? : Dan Barnes

Market volatility may shift rates back to voice in 2019

If predicted volatility pushes firms towards voice trading next year, rates traders will suffer from...

Treasuries crunch: Sponging up Treasury liquidity

A considerable increase in trade failures, combined with falling volume and buy-and-hold strategies is creating a shallow market in US treasuries, making the October...

OpenDoor reveals greatest challenge and a turbo-charged match rate

OpenDoor has revealed a significantly high match rate for asset managers on the all-to-all continuous order book it launched in January 2020, to replace...

Tradeweb to acquire Nasdaq’s eSpeed central limit order book

Electronic bond market operator, Tradeweb, has agreed to buy Nasdaq’s US fixed income electronic trading platform. The Nasdaq interdealer platform, formerly known as eSpeed,...

Tradeweb reports US$18.5 trillion traded in September

Market operator Tradeweb has reported a total trading volume for September of US$18.5 trillion, with an average daily volume (ADV) for the month of...

Liquidnet: 39% of buy-side firms rethinking use of TCA

By Flora McFarlane.

Traditional transaction cost analysis (TCA) could be a casualty in the shifting landscape of pre- and post-MiFID II regulation, with 39% of...