MiFID II has fallen short on transparency say traders

MiFID II has fallen short on transparency and will potentially create tiered access to market information, says Juan Landazabal, global head of fixed income...

State Street serves up ‘Cods and Chips’ in European bond market...

State Street has helped to uncover chatrooms, including one called "Cods and Chips" that are alleged to have been used by sell-side traders to...

Buy side calls for reform in US Treasuries

Treasuries market under the spotlight as US finance ministry takes stock in one of the most sweeping reviews of its kind. Anna Reitman reports.

The...

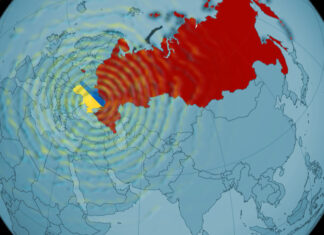

Market disruption spreads beyond Ukraine and Russia

Traders are reported that liquidity across developed and emerging markets is being hit, with trades taking far longer to complete and price formation suffering...

US Treasuries market picks up the electronic pace due to Covid-19

Covid-19 has triggered a “dramatic” shift in US Treasuries, the world’s largest bond market towards electronic execution from traditional voice trading, according to a...

Office of Financial Research: Treasury basis trades could pose systemic risk

A new paper from the Office of Financial Research (OFR) has cast doubt on the idea that basis trades increased the lack of liquidity...

ESMA lacks data to test bond market concerns

By Pia Hecher.

Regulators have acknowledged that bond market data is so sparse, even post-MiFID II, that they are unable to test execution quality concerns....

Coalition: Dealer fixed income stabilising, in a tale of two quarters

By Flora McFarlane.

Analyst house Coalition’s latest report on investment bank activity has shown mixed results for fixed income, currency and commodities (FICC) in the...

E-trading bond platforms outperform banks’ Q3 in fixed income trading

Market operator Tradeweb has seen a strong Q3 revenue against the same quarter in 2020, while electronic bond-trading MarketAxess has seen a slight decrease...

ISIN at issuance launched for Eurobonds by Origin

Origin Markets, the debt capital markets fintech, is launching an instant-ISIN feature, created in collaboration with international central securities depositary (ICSD) Clearstream, which is...