Hahn vows to continue drive for EU bond sovereign status

Johannes Hahn, commissioner responsible for budget and administration at the European Commission (EC) has said the organisation intends to continue its push for bonds...

FILS USA: Whither electronic bond trading?

Jenny Xiao of BlackRock and Chris Concannon of MarketAxess discuss the trends that are reshaping credit and rates markets in the Industry Crystal Ball...

Pre-fight analysis: The weigh-in for CME vs FMX

The launch of FMX, the derivatives exchange chaired by Howard Lutnick, CEO of interdealer broker and services provider BGC Group, sets out a potentially...

Country focus: India’s bond markets in an election year

India has an upcoming election on 19 April, which the governing Bharatiya Janata Party (BJP), led by incumbent Prime Minister Narendra Modi, is widely...

Derivatives Forum Frankfurt: Efficiency drives towards multi-asset trading

One of the primary reasons for the adoption of multi-asset trading is to improve efficiency, agreed ‘Trends in Multi-asset Trading’ panellists at this year’s...

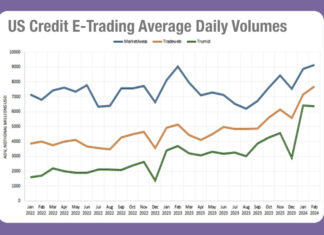

Exclusive: Analysing the battle for US e-Trading in February

The highly competitive corporate bond market saw average daily volumes converge in the US across electronic trading venues in February. The DESK has exclusively...

Coalition Greenwich: US Treasury e-trading volumes hit record in February

US Treasury volumes saw an average daily notional value (ADNV) of US$918 billion in February 2024, Coalition Greenwich’s March Data Spotlight has reported, up...

SGX anticipates Japanese growth with STIR futures

Singapore Exchange (SGX Group) plans to introduce short-term interest rate futures related to the Tokyo Overnight Average Rate (TONA) and the Singapore Overnight Rate...

Lars Salmon: On internal strength

Fidelity International has homegrown internal expertise and tech, to support a fixed income trading team that can weather all markets.

Lars Salmon is head of...

CME Group set to clear US cash Treasuries

A CME Group representative has confirmed to The DESK that the company is set to enter US Treasury clearing.

The news was first reported...