Liquidnet expands continental Europe coverage

Block trading specialist Liquidnet, part of the TP ICAP Group, has expanded its continental European coverage by deploying specialists in equities and fixed income...

MarketAxess EM extends coverage to Egypt, Hong Kong and Serbia

Bond market operator and data provider MarketAxess has added Egypt (EGP), Hong Kong (HKD) and Serbia (RSD) to its Emerging Markets (EM) local markets...

FILS 2021: Portfolio trading up threefold

Portfolio trading in fixed income has grown threefold in two years, data from Flow Traders reveal.

Speaking at the 2021 Fixed Income Leaders Summit (FILS)...

Symphony SPARC falls prey to debate on venue versus execution tool

Capital markets communication network, Symphony has been fined by the US derivatives regulator, the Commodity Futures Trading Commission (CFTC), after it found the firm’s...

Bryan Harkins joins Trumid

Electronic credit trading platform Trumid has appointed Bryan Harkins in the newly created role of chief revenue officer.

Harkins is an experienced executive with expertise...

EU begins NGEU bill auctions but secondary market needs support

The European Union’s new bond issuance auction programme started on 15 September, via the TELSAT auction system operated by Banque de France for its...

Yieldbroker partners with IHS Markit to support Australian bond issuance

Data, analytics and trading solutions provider IHS Markit is collaborating with Yieldbroker, the electronic trading platform for Australian and New Zealand debt securities and...

SMBC joins DirectBooks

DirectBooks, the capital markets consortium founded to make bond issuance more efficient, has seen SMBC Nikko Securities America, a member of SMBC Group, join...

Update: How big is portfolio trading?

In November 2020, we assessed the prevailing research on the size of portfolio trading in the corporate bond market. A new report from Coalition...

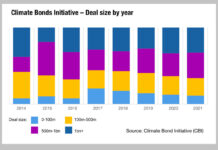

What’s big, green and keeps traders busy?

Bond issuance sizes in the ESG space are growing, and the average size of the deals are growing too. The proportion of benchmark-sized deals...