Analysis: Electronic trading across US and European bond markets

Electronic trading of US credit erupted in May 2024, according to analysis of the US credit market by Coalition Greenwich. It found that investment...

Subscriber

Meet the consolidated tape contenders

Europe’s development of a consolidated tape for trading data now has clear front runners and benefits.

Three firms have confirmed they will compete to be...

FILS USA: The three fierce battles for credit e-trading market share

Electronic trading in US fixed income is hotly contested between Bloomberg, MarketAxess, Tradeweb and Trumid all competing for market share of trading cash bonds...

The pros and cons of record issuance

Bond markets typically see increased liquidity around a bond shortly after it is issued. However, this does not mean that markets are automatically more...

High Yield issuance is taking off

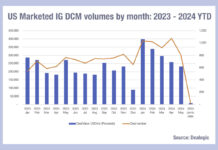

Comparing corporate bond issuance volumes for 2023 and 2024, we can see that the pattern is frequently a high start to the year, with...

Bigger / smaller: What sizes are optimal for electronic trading?

Credit trading has been transformed by evolving electronic execution, which has allowed buy-side desks to express investment ideas in to the market using more...

Eurex, Clearstream, VERMEG to broaden access to pan-European liquidity pool

Eurex has partnered with Clearstream and VERMEG, provider of the Eurosystem Collateral Management System (ECMS), to expand the use of collateral of its leading...

The credit trading processes you really should have automated by now…

Automation has historically been highly challenging in corporate bond markets for several reasons, but traders say some parts of the workflow ‘ought’ to be...

Jefferies moves into outsourced fixed income trading with Siegel hire

Industry veteran Jory Siegel has joined Jefferies as head of fixed income outsourced trading, from Marex.

Siegel was previously managing director and head of fixed...

MarketAxess industry viewpoint

Comparing portfolio trading and list RFQ TCA

By Gio Accurso, Grant Lowensohn and Jessica Hung, MarketAxess

Highlights and objectives

The MarketAxess Research team investigates any key...