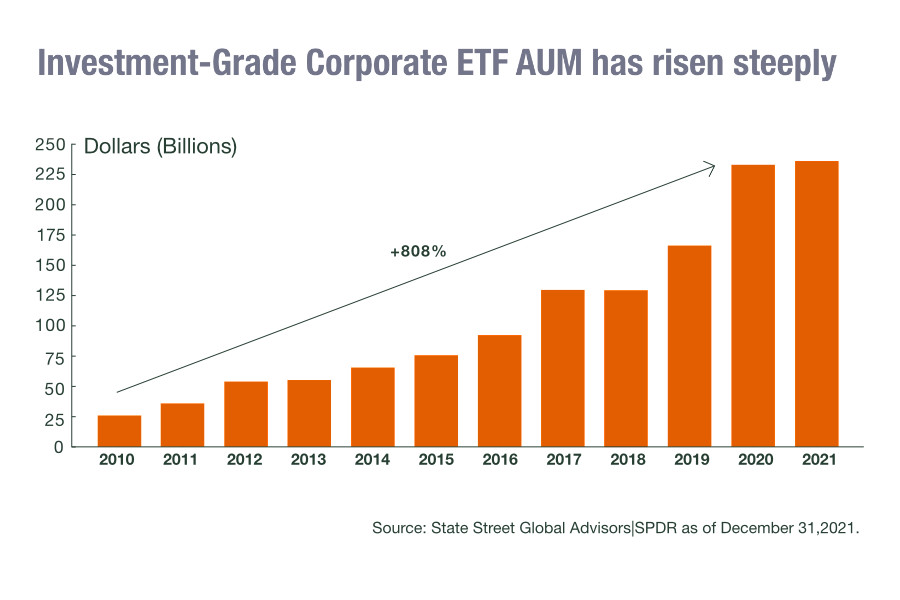

Fixed income markets are evolving at pace, with smarter electronic trading protocols, more sophisticated, automated investment strategies and a greater availability of useful data.

In this paper, co-authored by State Street Global Advisors SPDR® ETFs and MarketAxess, we explore this small but important evolutionary gap: how, with the launch of the new MarketAxess US Investment Grade 400 Corporate Bond Index, a more data-driven approach to indexation is paving the way for improved index and portfolio construction, and why greater innovation in indexation will be a catalyst for further market development.

©Markets Media Europe 2025