It would be understandable if trading in emerging markets (EM) debt were becoming more expensive as risk increased in many markets it makes up, as a consequence of the US tariff policy.

Different geographies within the EM category have, at times, seen positive and negative investment flows, over the past six months, but strikingly bond trading activity has been measured considering the potential disruption to international trade.

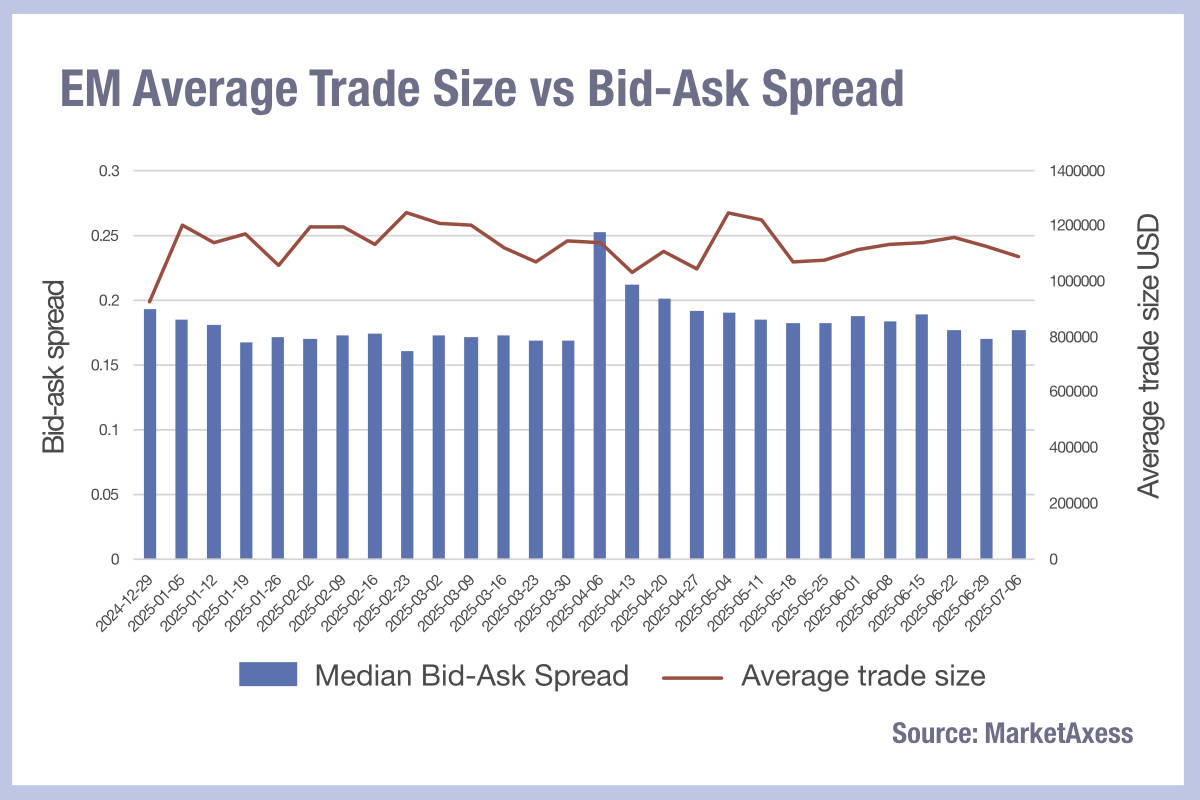

MarketAxess data from its TraX service which monitors activity across multiple markets, and its CP+ pricing services, indicates that the median bid-ask spread for hard currency jumped in April when the first US trade tariffs were threatened, and fell from there. At the end of June these fell back to pre-tariff levels.

The average trade sizes were not significantly affected by the tariffs but fallen since May, consistently holding below US$120,000. Trade volume and trace count have fallen after corresponding spikes in April.

This indicates the cost of liquidity and level of access to liquidity were affected by the threat of increased cross-border trade, but not in an outsized manner relative to developed markets.

Understanding this is key to assessing trading costs for buy-side traders, and highlights the value of pre-trade data in the EM space, where the fragmentation of trading across multiple jurisdictions makes data consolidation harder to form a unified picture of liquidity and pricing.

©Markets Media Europe 2025