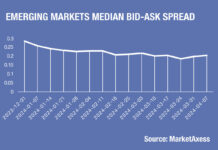

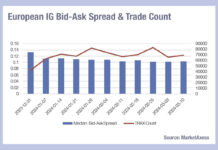

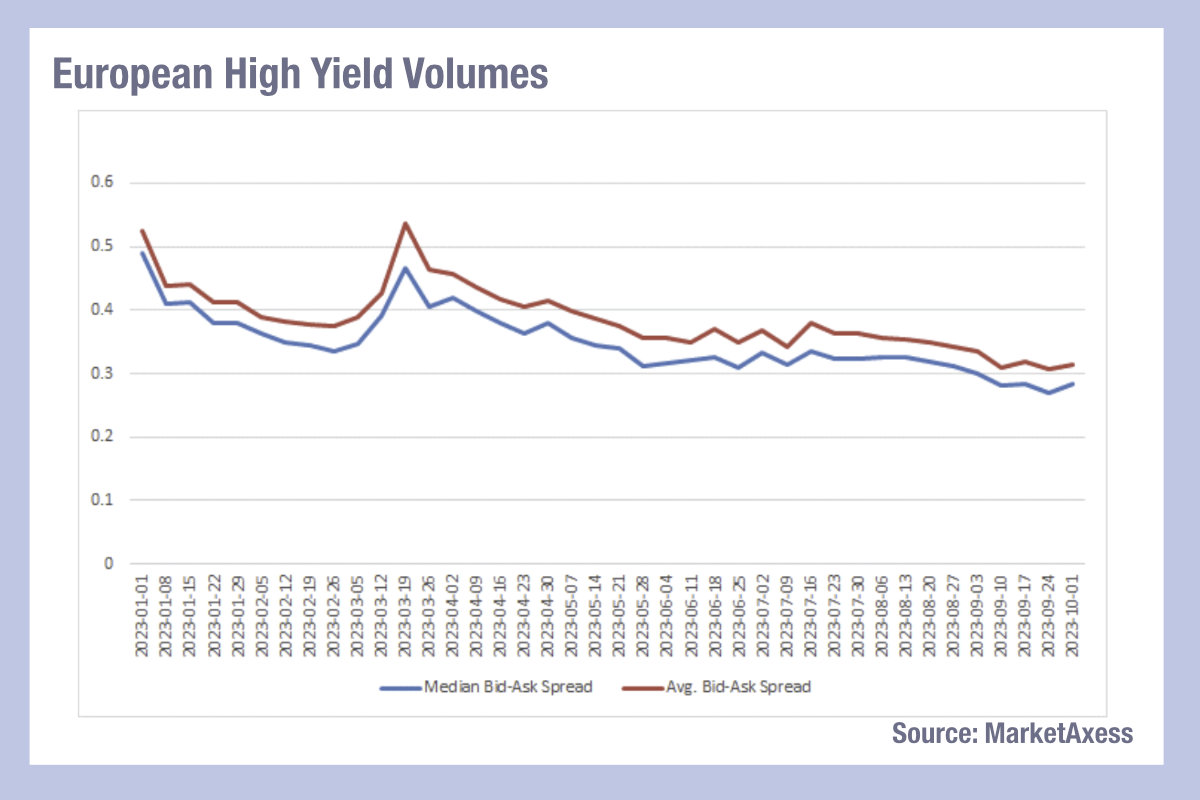

Since the start of 2023, European corporate bonds have seen a greater drop in bid-ask spreads than has been seen in their US investment grade (IG) and high yield (HY) and emerging markets (EM) counterparts, based on MarketAxess’s CP+ trading analytics.

The bid-ask spread is one measure of the cost of liquidity, and the implication is that this has been falling in Europe for corporate debt, or credit. Median European HY has fallen by 42% while the average has dropped by 40% year-to-date.

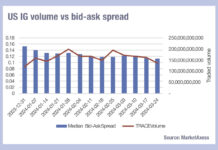

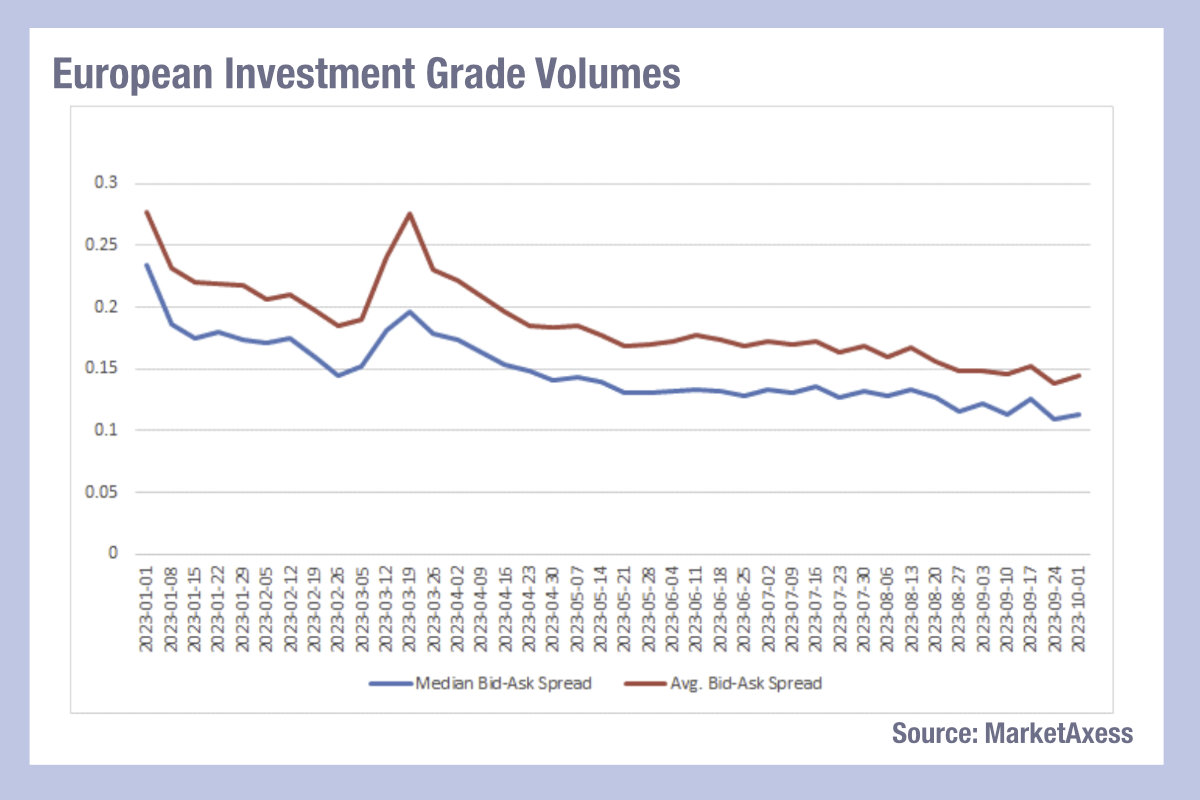

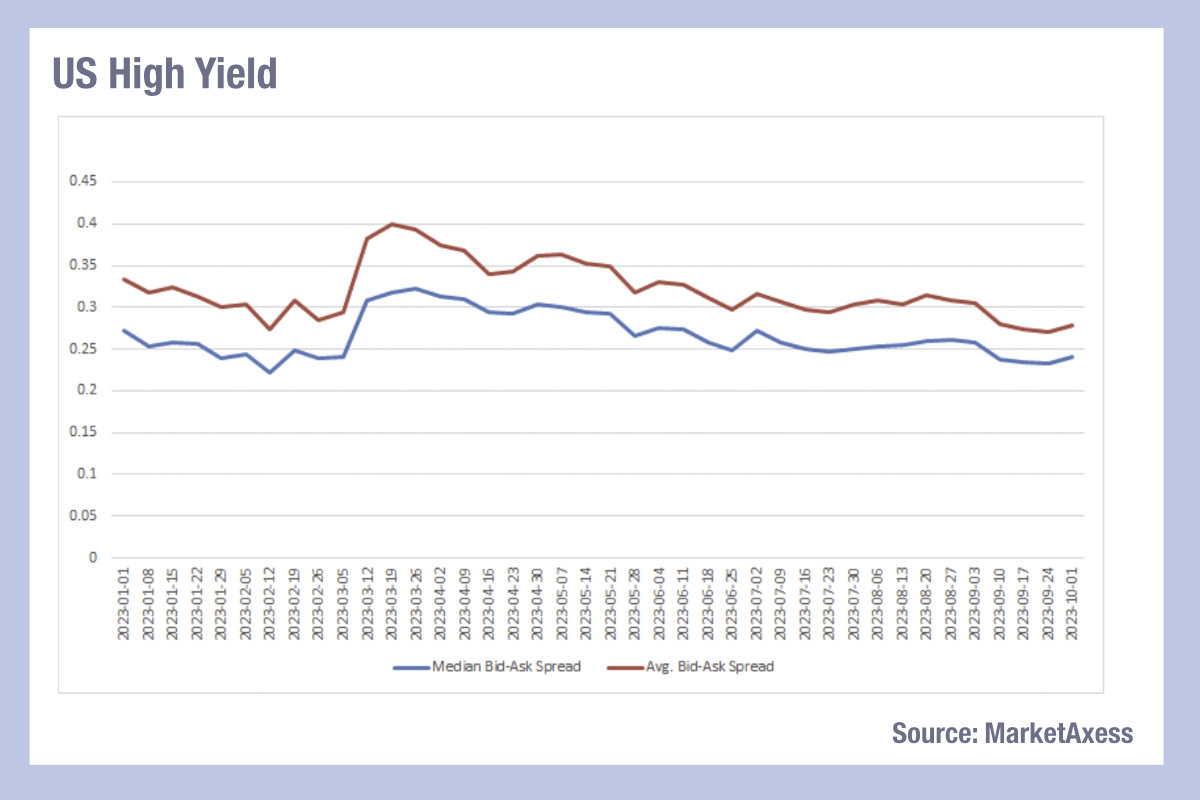

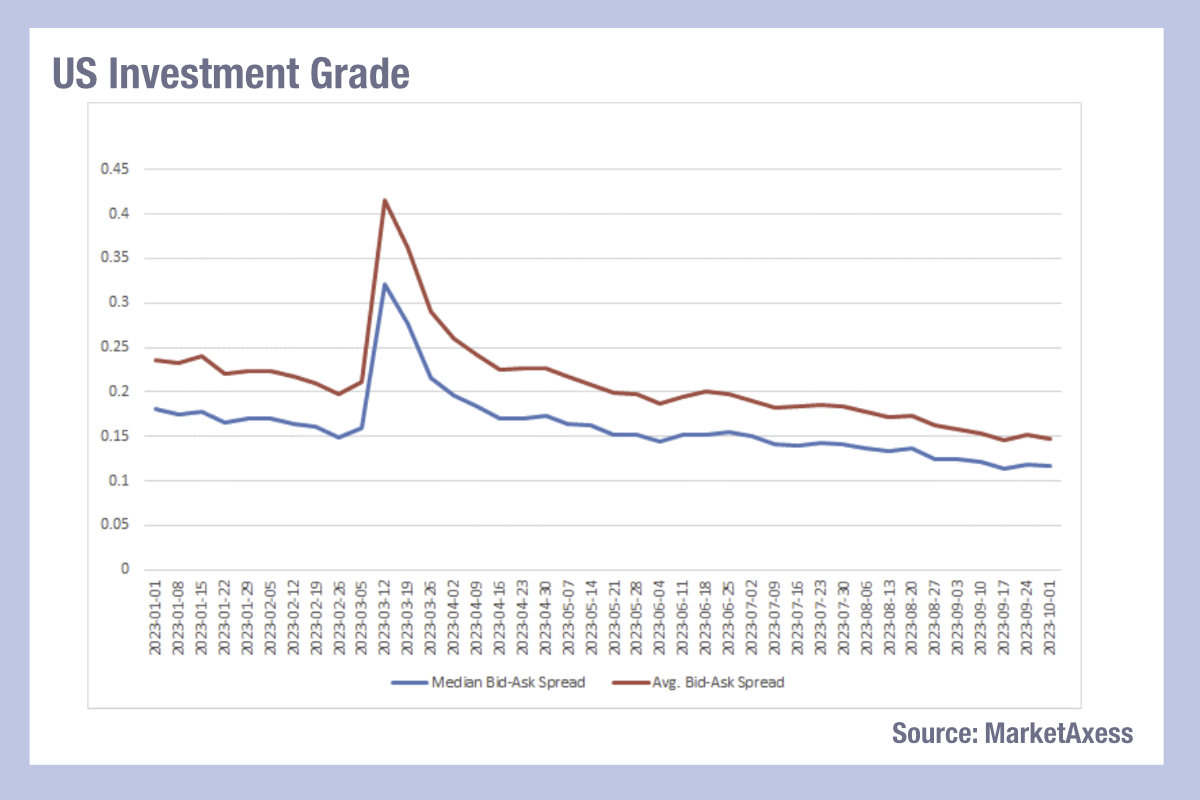

European investment grade has seen even greater drops, with a 52% median decline and average bid-ask spreads falling 47%. This suggests that the cost of trading European credit has fallen across the board this year. The drops are far greater than in the, already tight, US market, which has seen a decline of 11% (median) and 15% (average) bid-ask spread for high yield, and a 33% (median) and 35% (average) decline in bid-ask spread for investment grade corporate bonds. In that sense, European credit is looking increasingly cheap to trade. On the trading volume side of the business, volumes by notional traded are up 69% since the start of the year for European investment grade and by 55% for HY.

By contrast, US IG is up 25% year to date and HY has increased by 44%, measured by notional traded. While US market typically have a lower cost to access liquidity than their European credit counterparts, this picture does indicate that with higher volumes and falling bid-ask spreads, European credit is seeing a faster improving picture of liquidity so far this year.

©Markets Media Europe 2023