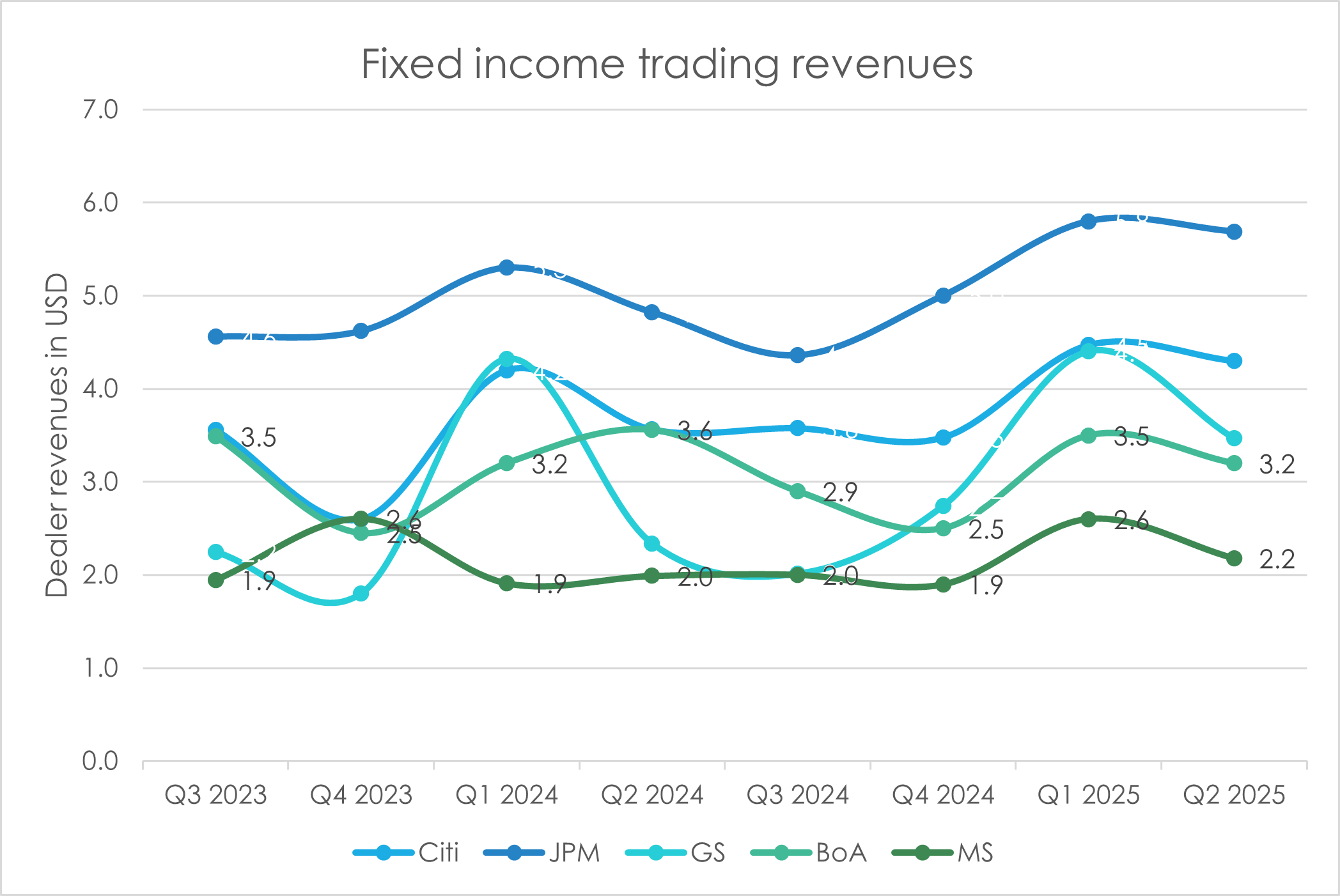

Wall Street banks posted US$18.8 billion in fixed-income trading revenues in Q2, driven by their activity in macro products, particularly rates and currencies. JP Morgan and Citi led the pack in revenues, as all banks highlighted the effectiveness of strategic balance-sheet deployment amid shifting market conditions.

JP Morgan maintained its leading position with US$5.7 billion in fixed income revenue, a 14% rise year-on-year (YoY), and a decrease of 2% quarter-on-quarter (QoQ). CFO Jeremy Barnum described the results as “pretty broad-based,” He remarked securitised products and repo financing activity was quieter than the rest of the FICC businesses. During the earning call, he emphasised significant capital deployment as essential to generating these results, cautioning that “growth isn’t coming for free; we are deploying quite a bit of capital and other resources to generate that revenue.”

Citigroup closely followed, with US$4.27 billion in fixed income markets revenue, a 20% increase YoY, and a decrease of 4% QoQ. It said results were supported by client hedging activity in treasuries and G10 currencies. CEO Jane Fraser attributed the strong results to “particularly strong” client flows in rates and currencies, supported by improved monetization and a rebuilt technology platform. Fraser said, “In April, I’d said that we were ready to lean in despite the lack of clarity of the moment, and indeed, we have.”

Bank of America secured third position, reporting US$3.2 billion revenue, a 16% improvement YoY but down 9% QoQ, driven, it said, by macro products across rates, foreign exchange, and commodities. CEO Brian Moynihan highlighted “good momentum in our markets businesses,” particularly emphasizing the macro desk’s ability to capitalise on client activity amid volatile market conditions.

Fraser said, “In markets, investments in our trading platforms have allowed us to handle record volumes with ease.”

Goldman Sachs recorded US$3.47 billion in fixed-income, currencies, and commodities (FICC) revenues, up 9% year-over-year but down 21% QoQ. CEO David Solomon noted “record financing net revenues” driven largely by strong performance in mortgage and structured lending, underscoring the strategic importance of balance-sheet deployment alongside flow trading activities.

The bank said, “Intermediation results were driven by higher client activity in currencies, credit and interest rate products partially offset by lower results in mortgages and commodities. Record fixed financing revenues of US$1 billion were driven by strong performance in mortgages and structured lending.”

Morgan Stanley reported US$2.18 billion in fixed-income revenues, a 9% increase YoY, but down 16% QoQ. The bank benefited from higher client activity, particularly in macro products such as rates and currencies, though commodities trading was softer. CEO Ted Pick highlighted the performance as validation of the bank’s integrated approach, noting how diversity across businesses supported robust outcomes even amid fluctuating market conditions.

Showcasing satisfaction with the results, he said, “Not so many years ago, we were talking about trying to get to a billion dollars a quarter, and now fixed income is quietly put up US$2 billion a quarter through every imaginable kind of environment for a whole bunch of quarters.”

©Markets Media Europe 2025