Industry insights for FILS EU 2023

FILS in Barcelona - Latest

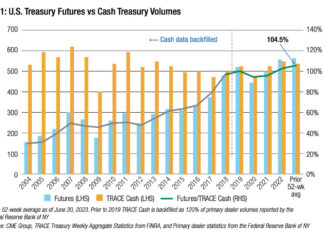

Treasury futures fight intensifies between FMX and CME

The US Fixed Income Leaders Summit 2025 showcased the fierce rivalry in the US treasury futures space, between incumbent giant exchange CME and upstart rival FMX, as both exchanged jibes on the conference stage....

Exclusive: US analysis of Trading Intentions Survey 2025

This year we're diving deeper into the Trading Intentions Survey. to give a more nuanced view of buy-side engagement with trading services, platforms and tools in the corporate bond market

Historical comparison of the...

Subscriber

FILS 2024: Could large number models help AI transform finance?

The enormous potential of artificial intelligence to change the way investment firms invest and trade in markets was explored at the Fixed Income Leaders Summit in Paris on Friday, with Revant Nayar, principal and...

What FILS delegates want

With the Fixed Income Leaders Summit (FILS) Europe upon us, The DESK has been speaking to attendees to discern what topics are most eagerly anticipated at this year’s event. From technology to transparency, market...

FILS USA: Opportunities remain in EM and ESG

Away from the US corporate and government bond market, this year’s Fixed Income Leaders Summit, emphasised the value of investing in both emerging markets bonds and explained how interest in the social aspects of...

FILS USA: Policy, predictions and reasons for optimism

While outlooks are often gloomy, speakers at this year’s Fixed Income Leaders Summit were optimistic about the future of the industry. That said, the road ahead will not be without its obstacles.

Beginning his presentation...

FILS USA: How all-to-all trading can break through the 17% barrier

Robert Fink, head of buy-side relationships at analyst firm Coalition Greenwich, opened a session at the Fixed Income Leaders Summit in Boston, by noting that all-to-all trading – as anonymous request for quote (RFQ)...

FILS USA: The most valuable fixed income asset is ‘People’

Much of the talk at last week's Fixed Income Leaders Summit in Boston centred around the mechanics of buying and selling bonds: data and analytics, liquidity sourcing, emerging technologies, trading protocols, and more. The...

FILS USA: Entry point for private credit liquidity providers “never been better”

Private credit has expanded rapidly in recent years, with the IMF recently reporting that the size of the market topped $2 trillion globally, of which more than three-quarters is in the US.

Some industry estimates...

FILS USA: Make sure you know which side you are on in US Treasuries

New US Treasury market regulations still have validity, ten years after the market’s infamous ‘flash jump’, as its need for resilience reflects multiple challenges and changes, observed participants at the Fixed Income Leaders’ Summit...

FILS USA: The complexities of routing an order

A great session on selecting trading protocols at the Fixed Income Leaders Summit in Boston, allowed traders to consider what really say behind counterparty and protocol choices when setting up a trade.

Alexcia Mazahreh, senior...

FILS USA: Adopt an EMS or face the consequences, panellist warns

Considering how trading desks can optimise new technology, panellists at this year’s Fixed Income Leaders Summit discussed how to prioritise automation efforts, what approach should be taken with AI, and reached a conclusion on...

The DESK: Systematic trading

The DESK discusses effective systematic trading, the benefits to end investors, and the skills needed to create and run systematic workflows with Chris Minck, BlackRock's EMEA head of systematic execution, and Meredith Herold, CEO...

FILS USA: The roadblocks to electronic fixed income trading

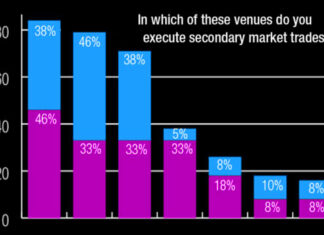

Fixed income markets moving toward electronic trading has been a recurring theme in the industry for a number of year, but there are roadblocks to progress to a more electronic future, with screen-based trading...

FILS USA: How ETFs drive adoption of new trading protocols

The critical role that portfolio trading plays in concentrated risk was laid bare in a discussion between Sanjay Jhamna, global head of credit trading at JP Morgan and Chris Bruner, chief product officer at...

FILS USA: Whither electronic bond trading?

Jenny Xiao of BlackRock and Chris Concannon of MarketAxess discuss the trends that are reshaping credit and rates markets in the Industry Crystal Ball Keynote Thursday morning at the Fixed Income Leaders Summit in...

FILS USA: Growing disparity in liquidity ‘haves’ and ‘have-nots’

Panellists at this year’s Fixed Income Leaders Summit agreed that industry collaboration, experimentation and greater competition are needed to improve liquidity across the fixed income space. However, with the disparity between firms who have...

FILS USA: The significance of portfolio trading breaking 10% volume

Record sized portfolio trades (PT) were reportedly responsible for pushing PT volumes up to around 10% of US credit market average daily volume in April, according to traders and market operators

“The month of...

Research: How mid-sized asset managers e-trade larger orders

The DESK’s research supported by LTX, finds liquidity improving, larger electronic trade sizes and greater use of data science pre-trade.

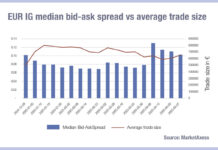

In 2024 bond markets are seeing an improvement in the supply of liquidity and narrower...

Subscriber

FILS USA: The three fierce battles for credit e-trading market share

Electronic trading in US fixed income is hotly contested between Bloomberg, MarketAxess, Tradeweb and Trumid all competing for market share of trading cash bonds in the dealer to client (D2C) market.

The dynamics behind these...

FILS USA: Has US Treasury clearing mandate killed all-to-all trading for the buy side?

While there are still questions around the effect of US Treasury reforms on market structure, many buy-side traders will be focused on the impact that clearing will have and whether all-to-all trading will remain...

FILS USA: How can high yield be traded efficiently in a risk off environment?

Banks are stepping back from taking risk in high yield trading. Trading in a risk-off environment in normal circumstances can be challenging as spreads widen and volumes decline.

“Gone on the days where you...

FILS in Barcelona: Breaking up the monoculture

Diversity is not always visible, but its impact is. This was the key takeaway from the panel discussing ‘Launching new Diversity, equity and inclusion (DE&I) initiatives’ which sought to address the meaningful progress of...

FILS in Barcelona: ‘Spectre at the feast’ as recession looming despite falling inflation

At FILS 2023, Amir Fergani head of fixed income France & EMEA at Generali Insurance Asset Management, Philippe Waechter, chief economist at Ostrum Asset Management and Stefan Hofrichter, chief economist at Allianz Global Investors,...

FILS in Barcelona: Generative AI is not going to take our jobs – yet

In a discussion on the potential future impact of AI on financial markets, particularly fixed income, Venky Vemparala of FlexTrade and Plamen Mitkov of Yield Book told Carsten Just, formerly head of fixed income...

FILS in Barcelona: What blockchain can do for bond markets

What progress is being made in the world of blockchain, and how is DLT technology transforming the world of digital bonds, crypto trading, and custody?

This was the topic of discussion for Valérie Noël of...

FILS in Barcelona: Tough calls for investors

Big picture phrases like ‘higher for longer’ and ‘transitory’ inflation are too imprecise to guide a professional investor, the Fixed Income Leaders’ Summit (FILS) in Barcelona heard today.

Instead investment strategy needs to be based...

FILS in Barcelona: What a T+1 world will look like for fixed income

At FILS 2023, Stephanie Fraser of Baillie Gifford and Katia Felina, head of post-trade product at Bloomberg, discussed the future in both Europe and the US for a T+1 settlement – noting that actually,...

FILS in Barcelona: Should you be switching from high yield bonds to leveraged loans?

Thierry De Vergnes, managing director of acquisition debt funds at Amundi, presented a compelling case at FILS 2023 for why high yield loans are the asset class to be in right now.

Thierry...

FILS in Barcelona: No clear resolution on data ownership but much good will

The challenges of data ownership and the commercial provision of data were tackled head on, at the Fixed Income Leaders Summit in Barcelona, with a panel of traders, dealers and commercial data providers agreeing...

FILS in Barcelona: How ETF evolution is a key prop for liquidity

Understanding the effect of exchange-traded funds ETFs in supporting liquidity for fixed income is crucial, since it has become an integral part of the market.

“In European investment grade (IG), the tickets of around...

FILS in Barcelona: The modernisation of the bond market

A massive modernisation of the bond market is being recognised at the Fixed Income Leaders’ Summit in Barcelona.

Although the event was largely held under the Chatham House Rule, it was clear that the...

FILS in Barcelona: What will help traders best adapt to the new bond market?

Although the basic function of a trader – price and liquidity formation – has remained the same over the past two decades, the level of market fragmentation in that period has been in flux,...

FILS in Barcelona: How will trading technology bridge the adoption gap?

On 9 October 2023 the UK’s rules on the trading venue perimeter – drawing a line between desktop technology and regulated trading venues – will come into effect.

With electronification of trades continuing to increase...

FILS in Barcelona: If the future is futures, what happens when the market is...

Moving liquidity from the spot or cash markets into futures is raising some concern amongst market participants. In FX, trading volume on the Thomson Reuters and EBS markets, which are considered ‘primary markets’ by...

This page is dedicated to reports from The Fixed Income Leaders Summit, Barcelona, 2-4 October, 2023. Sessions on the 2nd October, the Buyside Evaluation day, will not be reported.

While every attempt is made to record delegates accurately and obtain quote approval prior to publishing if there are any inaccuracies please contact Dan Barnes.