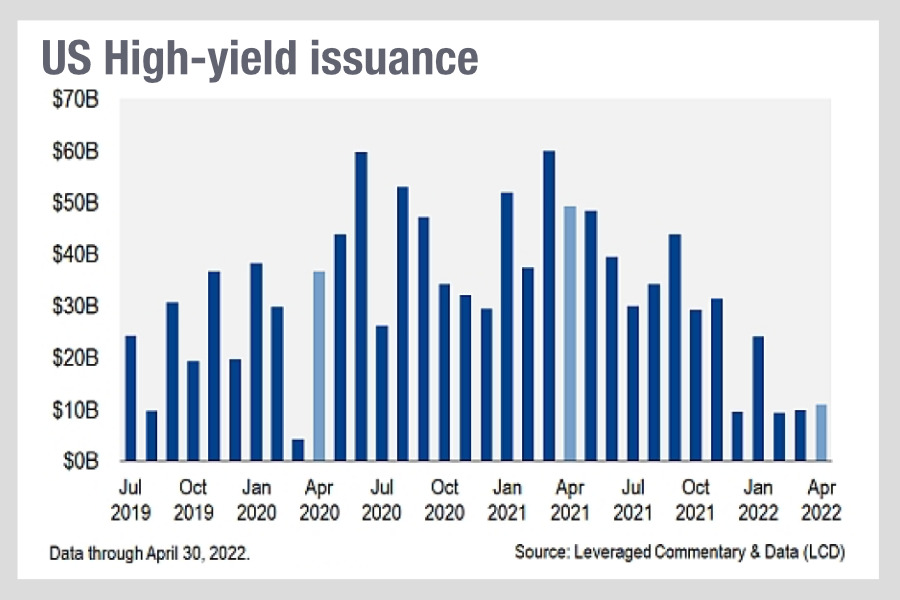

It costs more to borrow money in the US right now, than it has for a long time. Even more so for companies in the high yield (HY) realm of credit ratings.

According to research by S&P Global Market Intelligence, the average yield at issuance for new HY offerings in April 2022 “swelled to a three-year high at 7.28%, up 32 bps from March, and versus an all-time low at 4.99% in September 2021, a month capped by the Fed’s unambiguous rhetorical pivot to hawkish policy for the quarters to come, and presaging the half-point rate hike announced on 4 May.”

Where refinancing was the driver for 60% April 2021’s total issuance, and an approximate 79% of issuance in Q1 that had dropped to less than 15% in April 2022 which S&P notes is “a low share for any month since January 2016” while in Q1 it made up just 53% of volume. The gross volume of refinancing dropped to US$24.5 billion for the first four months of 2022, the lowest level since 2009, just after the global financial crisis.

Borrowing has not disappeared – debt issuance to support M&A deals and share buy-backs is increasing – but it has reduced. Analysts at banks have cut expectations for total issuance by anywhere from 20-40%, with S&P reporting that Barclays estimated high-yield bond supply to hit US$240-260 billion, from previous estimates of US$400-420 billion range and BofA lowering estimates to US$340 billion, from US$425 billion.

If that is correct, stress on trading desks will be reduced on one side, as primary market workflows are still very manual in the US, despite the increasing adoption of DirectBooks, a tool designed to electronify the process.

On the other hand, any pressure on corporate debt to refinance itself can also create stress for portfolio managers, who either need to support their access to debt of the right calibre, or may be concerned about shifting debt where its credit risk is increasing.

Buy-side traders can add more value to secondary market trading, so if the secondary market for US HY debt becomes more competitive – and we are seeing bid/ask spreads drop in HY, as well as a decrease in the difference between median and average bid/ask spreads, potentially signalling that will be the case – it could be that buy-side traders are in fact in their element in US high yield. They will have more time to do what they do best – finding liquidity and the best prices for investors.

©Markets Media Europe 2025