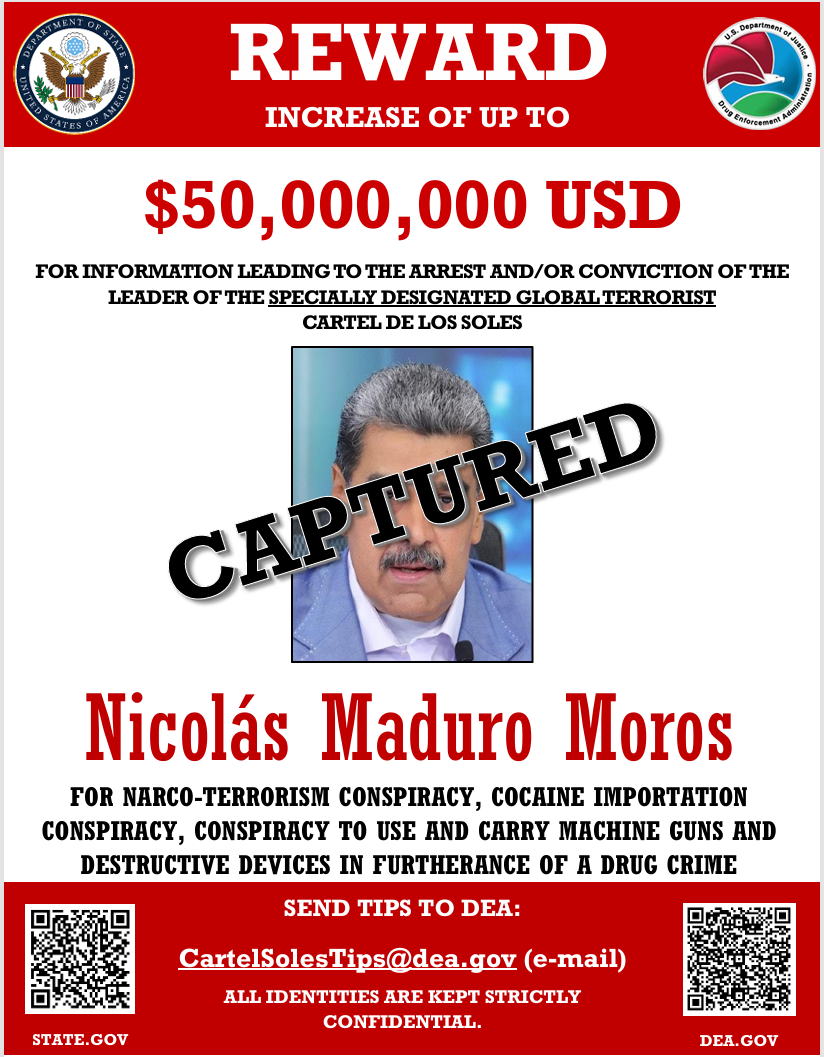

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a striking rally in distressed sovereign debt. Venezuelan bonds, long frozen in default and trading at deeply distressed levels, have surged as investors reassess recovery prospects in light of the country’s sudden political transition.

The dramatic escalation of Venezuela’s political crisis — culminating in the US military operation that removed Nicolás Maduro from power — has triggered a striking rally in distressed sovereign debt. Venezuelan bonds, long frozen in default and trading at deeply distressed levels, have surged as investors reassess recovery prospects in light of the country’s sudden political transition.

Prices on Venezuela’s benchmark notes due in 2026 have doubled since summer, with the 2027 9.25 government bond listed on the Munich Stock Exchange hitting 39% of par in 2026, up from 20% of par in July 2025.

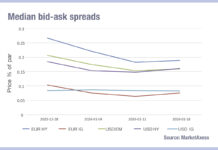

As speculators stepped in to seize the potential recovery of debt assets, a significant level of activity moved to electronic trading, in order to reduce the friction of finding available bonds. MarketAxess reported $172mm of total trade volume between 5 and 6 January, of which $67mm was trading in Venezuela sovereign bonds and $105mm in the corporate bonds of PDVSA, the state oil company.

This constituted 447 total trades, 1174% higher than the 2025 daily average, broken up across 221 Venezuela sovereign trades and 226 PDVSA trades. As investors reassess the prospects of recovery in light of the country’s sudden political transition, the prices on Venezuela’s benchmark notes due in 2026 more than doubled since late summer.

The sharp repricing of the bonds reflects a shift in expectations, with some market participants betting that a post‑Maduro government, led for now by acting president Delcy Rodríguez, will normalise relations with Washington and open the door to long‑delayed debt restructuring. The US Treasury’s sanctions regime has been an obstacle to any restructuring effort, as transactions involving Venezuelan debt can require explicit authorisation from the Office of Foreign Assets Control. With the US signalling a willingness to engage, investors see a clearer path to asset recovery.

Yet the situation is still unstable. Thomas Watter of S&P Global and Rishabh Dakalia of Crisil, part of S&P Global, noted that US President, Donald Trump, said the US would “run the country until such time as we can do a safe, proper and judicious transition” and rebuild Venezuela’s oil sector via US companies.

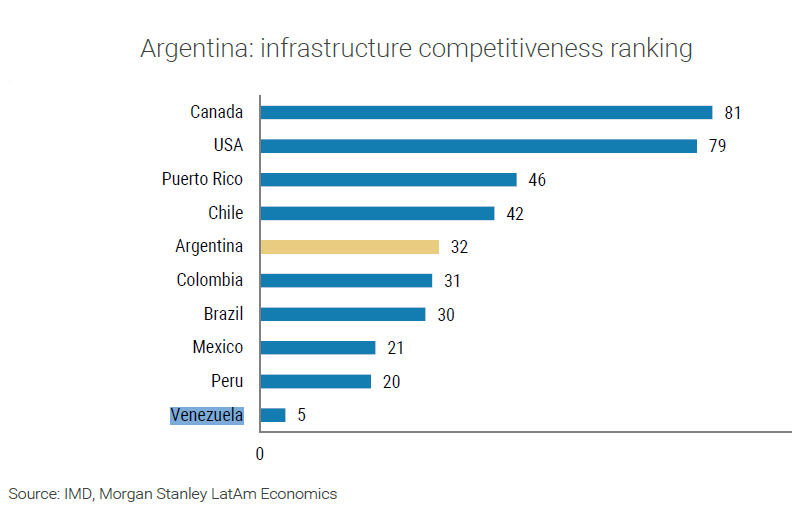

“However, S&P Global Ratings expects a recovery will take years and significant capital to develop the underinvested and outdated oil and gas infrastructure,” they write. “For example, according to the Venezuelan Hydrocarbon Association, the nation’s five refinery complexes are operating at only 10% of nameplate capacity and would require more than US$10 billion-15 billion to bring that to greater than 80%.”

The broader market implications are complex. Morgan Stanley notes that the crisis introduces significant political and operational uncertainty, but the near‑term effect is unambiguously supportive for Venezuelan bonds, which are likely to continue rallying, as long as investors believe a stable government and sanctions relief are plausible outcomes. At the same time, the crisis has tested the US dollar’s safe‑haven status and contributed to increased demand for gold, reflecting heightened perceived geopolitical risk.

The Venezuelan crisis transformed one of the world’s most moribund sovereign debt markets into a high‑beta play on political transition. The rally has been substantial so far, but questions remain about the durability of the new government, the agreement with the US, the pace of any sanctions relief, and the feasibility of restructuring more than US$170 billion in obligations.

As demonstrated in the adrenaline-filled days around the removal of Maduro, for bond traders, having rapid and frictionless access to pricing and liquidity could make the difference between seizing or missing an opportunity.

©Markets Media Europe 2025