In late October 2025, Argentine President Javier Milei’s party, La Libertad Avanza, scored a decisive win, in the country’s midterm elections, a political triumph that significantly strengthens his mandate and numbers in congress to implement radical economic reforms. The win, particularly in the historically Peronist stronghold of Buenos Aires province, surprised many observers after earlier election in Buenos Aires had suggested his support was faltering, the outcome potentially marks a turning point in Argentina’s political and fiscal trajectory.

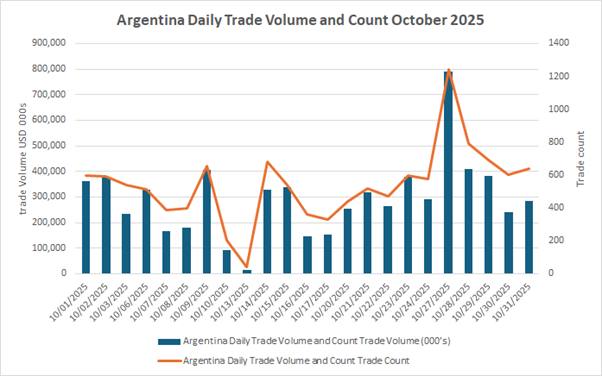

For traders, this surprise was measurable in the substantially increased use of block trades, that allowed rapid transfer of risk for large positions, and of all-to-all electronic trading, both of which reduce the market impact of orders, and accelerate order matching speeds.

Source: MarketAxess platform data

Source: MarketAxess platform dataOn Monday 27 October after the weekend election, dollar-denominated government bond prices jumped. Analysts at Morgan Stanley noted that Argentinian debt resulted in swings in fund alpha, with overweight positions paying off in the week after the election. Trading volumes spiked but trade sizes did not, indicating that trading was conducted at speed across large and small orders.

Inconclusive value picture

“Argentina’s YTD performance has reached 10.1%, 18.8% returns just this past week,” wrote Simon Weaver, Emma Cerda, Neville, Mamdimika and Guru Sharan Agrawal, all strategists at the bank. “While strong, this is still below the 13.2% YTD index returns, meaning OW positions have not yet paid off this year.”

In October, average daily volume (ADV) of Argentinian bonds on MarketAxess hit US$307 million, an increase of 41% year-to-date ADV of US$217 million.

“Funds likely went into the elections this weekend with less risk on,” noted the Morgan Stanley strategists in an 30 October note. “Looking at our EPFR data with a smaller sample of funds, we find that just in September, funds reduced exposure to the name by 0.36 percentage points (pps) to bring exposure closer to flat, below historical averages. While October data are not available, this suggests that funds went into the recent elections with less exposure to the credit. That said, just on Monday [27 October], funds gained 12bp in fund alpha on aggregate, increasing MTD alpha to -5bp. If only driven by Argentina, this would suggest that funds were able to benefit from the move, although not by enough to turn MTD alpha positive.”

However, Argentina’s YTD performance has reached 10.1%, which is below the 13.2% YTD index returns, they observed, meaning OW positions would not yet have paid off this year.

The US Treasury has extended a US$20 billion FX swap line and has reportedly bought Argentinian pesos at several points over the past month.

This emphasises the need for investors to deliver effective trading of their positions in order to minimise trading costs. On the MarketAxess platform, October saw the ADV of block trades – meaning orders over US$5 million in value – hit US$40 million, where year-to-date block trading ADV had been US$28 million.

Its Open Trading protocol saw ADV of US$255 million in October, also a substantial increase on YTD ADV of US$176 million.

Investors look ahead

The midterm results now give Milei’s Liberty Advances party greater legislative leverage to push through sweeping reforms in labour, taxation, and public sector restructuring. This consolidation of power will be crucial for implementing his vision of a leaner state and a free-market economy.

Yet despite his rhetoric of fiscal discipline, Milei’s government had paradoxically increased spending in areas such as pensions, health, and education in the lead-up to the midterms. This move, seen by some as political pragmatism, also raised questions about the sustainability of his zero-deficit pledge. While his administration has made strides in reducing inflation and narrowing the gap between official and parallel exchange rates, the durability of these gains depends on maintaining investor confidence and access to external financing.

Milei’s approach to government borrowing is shaped by his deep scepticism of debt-fuelled public spending. However, Argentina’s economic reality – marked by a history of defaults, inflation, and capital flight – necessitates engagement with international lenders.

Judging Argentinian investment in 2026

Since taking office, Milei has negotiated new arrangements with the International Monetary Fund (IMF), securing continued disbursements in exchange for structural reforms. While this has helped stabilise Argentina’s macroeconomic outlook in the short term, it also deepens the country’s dependence on external creditors.

On one hand, a credible commitment to fiscal discipline could lower borrowing costs and restore access to capital markets. On the other, the reliance on IMF support and the social toll of austerity may undermine long-term stability.

Milei’s success will be judged not just by his ability to cut deficits, but by whether he can do so while preserving social cohesion and economic growth. As seen by returns to date, emerging market investors will need to be well compensated for the risks taken in investing in Argentinian debt over alternatives. The next year will be critical in determining whether Argentina can finally break free from its cycle of debt and dysfunction.

©Markets Media Europe 2025