Tom Harry, Head of Cash, Derivatives & Regulation Product Management at MTS

MTS has a strong track record of building robust interdealer and dealer-to-client franchises, particularly in the bond and repo markets. Our average daily turnover has increased rapidly and now surpasses €160 billion across all our platforms.

However, we’re not content to stop there. We’re committed to ongoing innovation in order to meet the full spectrum of our clients’ needs. That’s why we’ve expanded our rates offering to interest rates swaps.

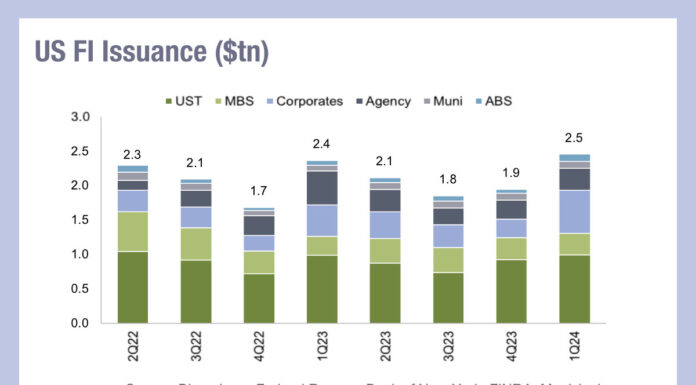

Why interest rate swaps? Because market participants in this space are perfectly primed to unlock the significant benefits of workflow digitalisation, both in the interdealer and dealer-to-client markets.

Introducing MTS Swaps

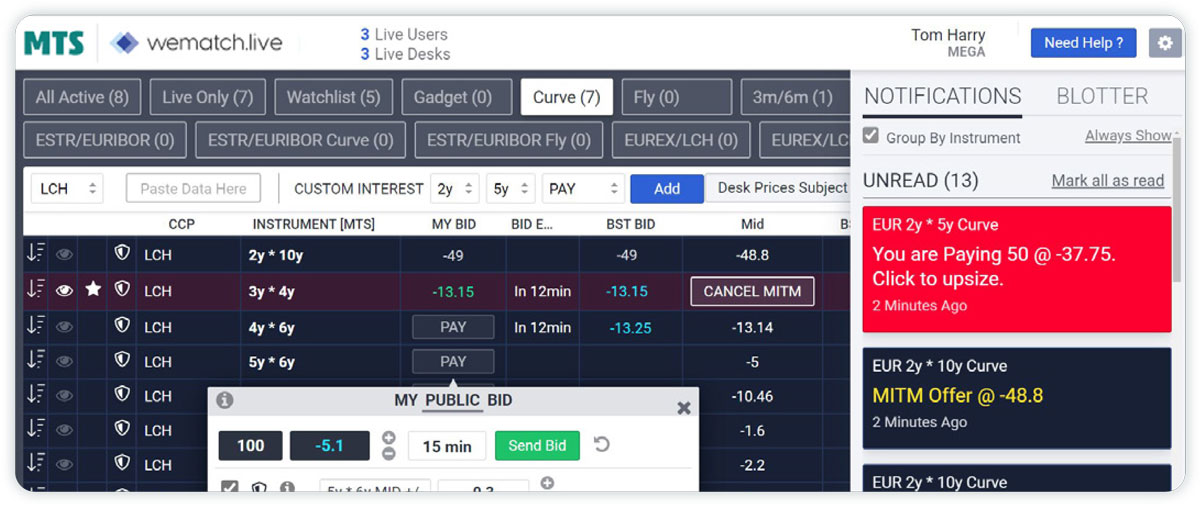

MTS joined forces in February 2023 with Wematch, a fintech innovator, to launch MTS Swaps by Wematch.live, an interdealer web-based trading platform for the interest rate swaps market. MTS Swaps bridges legacy voice trading models and pure electronic alternatives by offering innovative negotiating functionalities, such as Risk Netting, Meet-in-the-Middle and Work-Up.

MTS Swaps currently supports straightforward digital negotiation and execution of package transactions across its regulated EU MTF and UK MTF, including Curves, Flies, 3m/6m Tenor Basis, ESTR/EURIBOR Basis, EUREX/LCH Basis, and Gadgets.

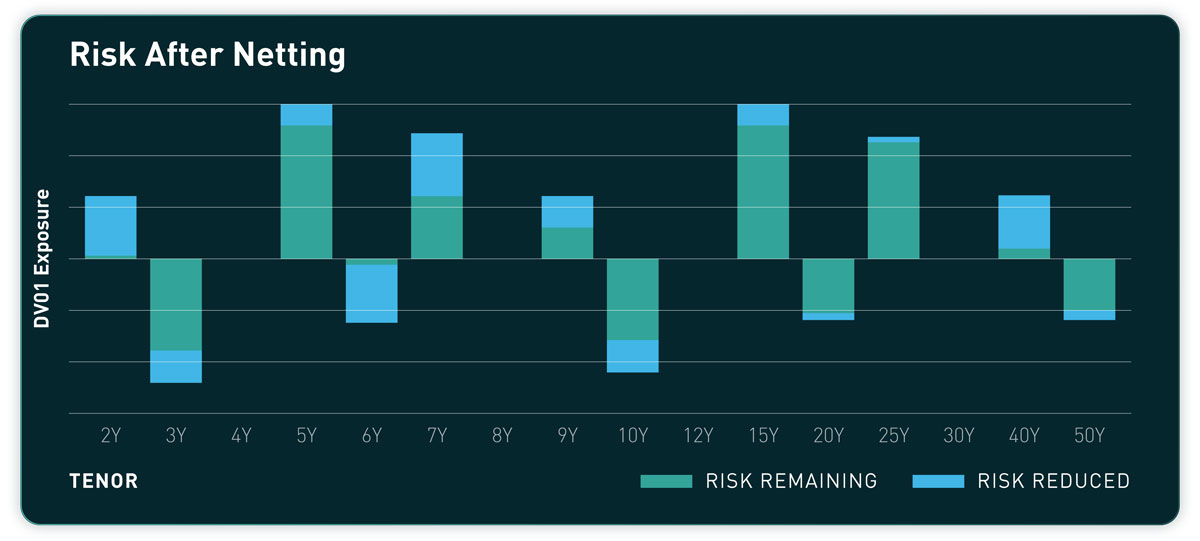

In June 2023 we launched the MTS Swaps Risk Netting Service to automate the netting of interest rates swaps positions. Liquidity is concentrated during timed sessions where traders upload their interests, without disclosure to the market.

The benefits of digital workflows

The benefits to market participants of this approach are clear. Automated workflows that support the straightforward negotiation and execution of package transactions increase efficiency and productivity and generate significant time savings. There’s a cost benefit too – MTS Swaps offers a simple and transparent fee schedule with a choice of “all-you-can-eat” or “pay-per-trade”, meaning the solution can dramatically reduce the cost of trading.

MTS Swaps is also an important tool in reducing conduct risk. The platform provides a complete electronic audit trail of trade processes, from order entry to trade execution, and eliminates chat from workflows entirely. The solution protects financial institutions in other ways too, such as through pre-trade price and size controls, auto-protect features to mitigate market volatility, and the ability to cancel trader and desk prices with a single click.

In short, our new MTS Swaps platform enhances trading workflows by bringing market-leading functionalities to market participants in one of the world’s largest derivatives markets. What’s more, it is a continually evolving proposition, as we work with participants to add new functionality.

Coming soon: BondVision Swaps

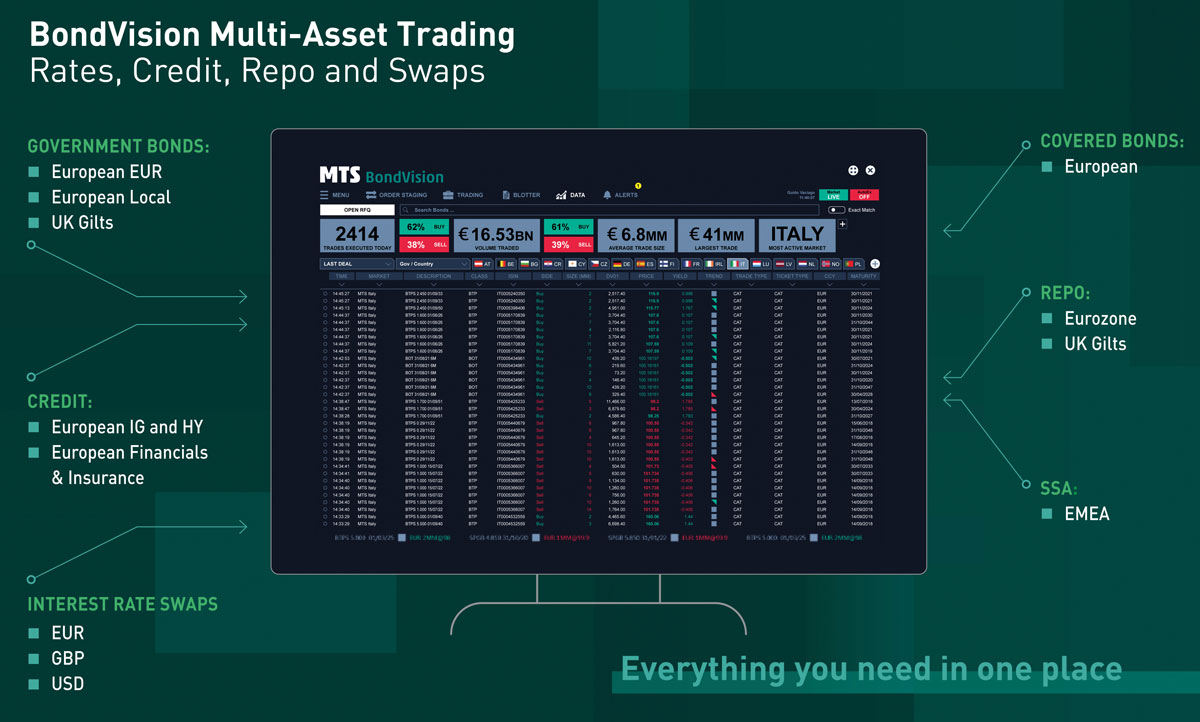

We’ll shortly extend BondVision, our regulated and secure multi-dealer-to-client trading platform for bonds and repo, to support interest rate swaps using the Request for Quote (RFQ) and Processed Trade functionalities. This will allow our existing client base to trade bonds, repo and swaps within the BondVision franchise, providing a richer experience for buyside clients and greater opportunities for dealers to service their clients. This will also inject competition into a market that has been dominated by the incumbent platforms.

MTS is committed to building a better interest rate swaps market. The market will become more electronic and automated as we streamline workflows, connect market interests, make it easier to source liquidity, and help firms reduce conduct risk. Get in touch to learn more about how MTS Swaps can transform your interest rate swaps trading.

Contact: mts.swaps@euronext.com