By Tom Harry, Regulatory Specialist at MTS

By Tom Harry, Regulatory Specialist at MTS

The upcoming implementation of MiFID II will have wide-ranging implications for fixed income trading. From 3rd January 2018, fixed income market participants will have to navigate new rules covering the European Economic Area (EEA) under MiFID II, which aims to make financial markets more efficient, resilient and transparent.

Bond market transparency

One of the most widely anticipated – and sensitive – aspects of the new rules is the pre- and post-trade transparency regime for bonds. The scope of the transparency requirements is very broad: all bonds admitted to trading on an EEA trading venue will be eligible for transparency.

Whereas a substantial portion of bond market activity in the pre-MiFID II world is private to the counterparties to a negotiation, from 3rd January a far wider audience will be able to monitor real time post-trade and even pre-trade information in some cases for venue and OTC activity.

Two of the key challenges facing market participants in the MiFID II world will be to understand who is responsible for managing transparency and when transparency will apply.

Trading venues will be responsible for managing transparency for activity on their venues. However, market participants face a complex and uncertain regime for OTC activity, from the prospect of named pre-trade transparency when interacting with counterparties who are captured by the Systematic Internaliser regime to determining which counterparty to a trade should report it to an Approved Publication Arrangement (APA).

ESMA thresholds for bonds

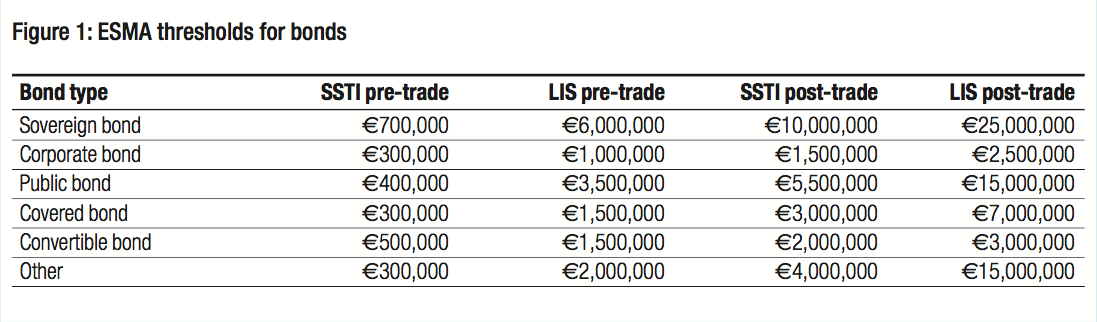

As part of its preparations for MiFID II, the European Securities and Markets Authority (ESMA) has published the initial Large in Scale (LIS) and Size Specific to the Instrument (SSTI) thresholds for bonds (see Fig 1).

These thresholds, however, are just part of a wider framework determining the pre- and post-trade transparency obligations. Bonds defined as illiquid will be able to benefit from waivers and deferrals. Money Market Instruments such as treasury bills and similar instruments fall entirely outside of the transparency regime. Add to this the ability for each EEA Member State to tailor the post-trade transparency regime as they see fit and it is not difficult to see that the transparency regime will become difficult to manage for market participants.

MTS BondVision Transparency Rules Engine

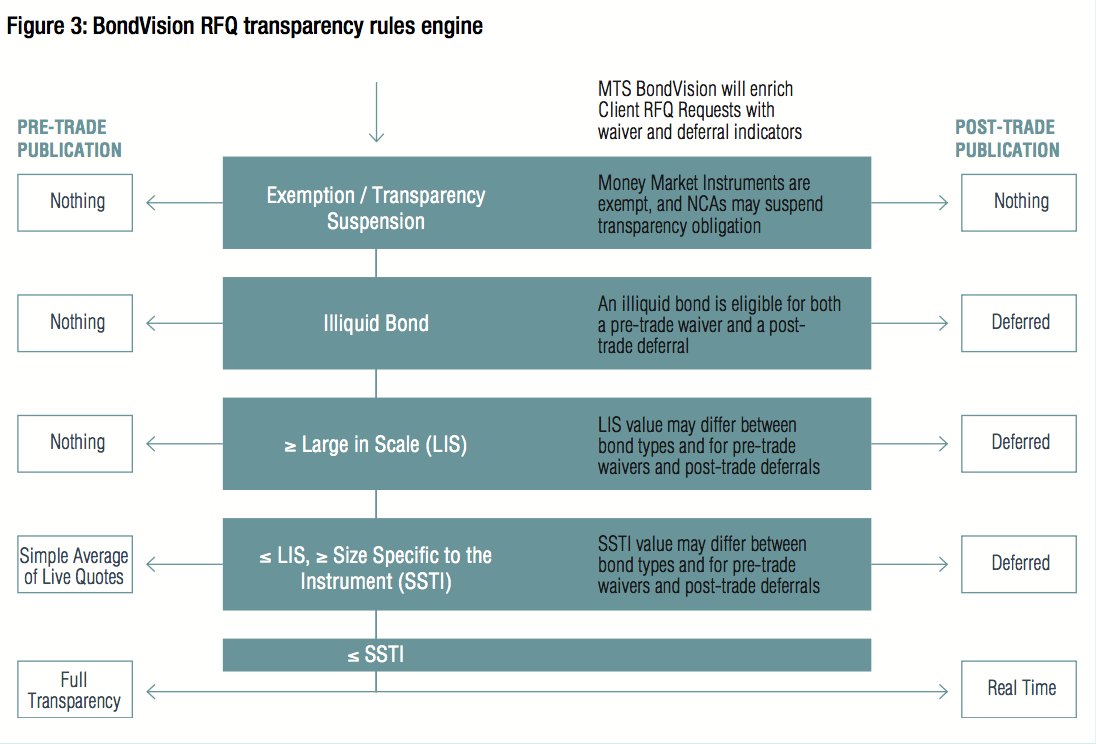

In response to concerns raised by market participants around navigating the complexity of the transparency regime, MTS has developed the MTS BondVision Transparency Rules Engine, a functionality within its BondVision trading platform, to allow market participants to navigate the pre- and post-trade transparency regime.

In addition to informing traders prior to any negotiation on BondVision about when and in what form any pre- or post-trade information would be published, the pre- and post-trade information is filtered by the BondVision Transparency Rules Engine for any transparency waivers, deferrals or exemptions. This allows MTS to minimise any impact that the transparency regime could have on trading activity.

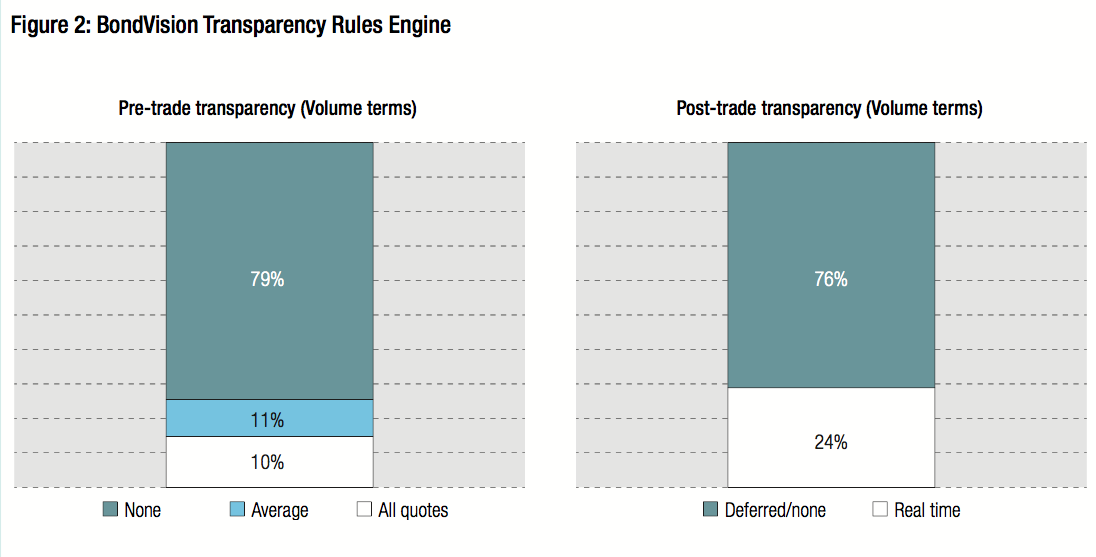

MTS has analysed the extent to which the BondVision Transparency Rules Engine would have managed transparency between July and mid-November, while ignoring bond liquidity and participant exemptions ahead of the ESMA’s first liquidity calculation (see Fig 2).

Even without considering bond liquidity, pre-trade information would not have been disclosed for almost 80% of MTS BondVision traded volumes. Similarly, over three-quarters of post-trade information would have either been deferred or undisclosed. The BondVision Transparency Rules Engine offers the opportunity for market participants to mitigate the impacts of the MiFID II transparency regime on their trading activity (see Fig 3).

MTS Cash and MidPrice

The MTS Cash interdealer order books already embody the principles of pre- and post-trade transparency that are promoted in MiFID II.

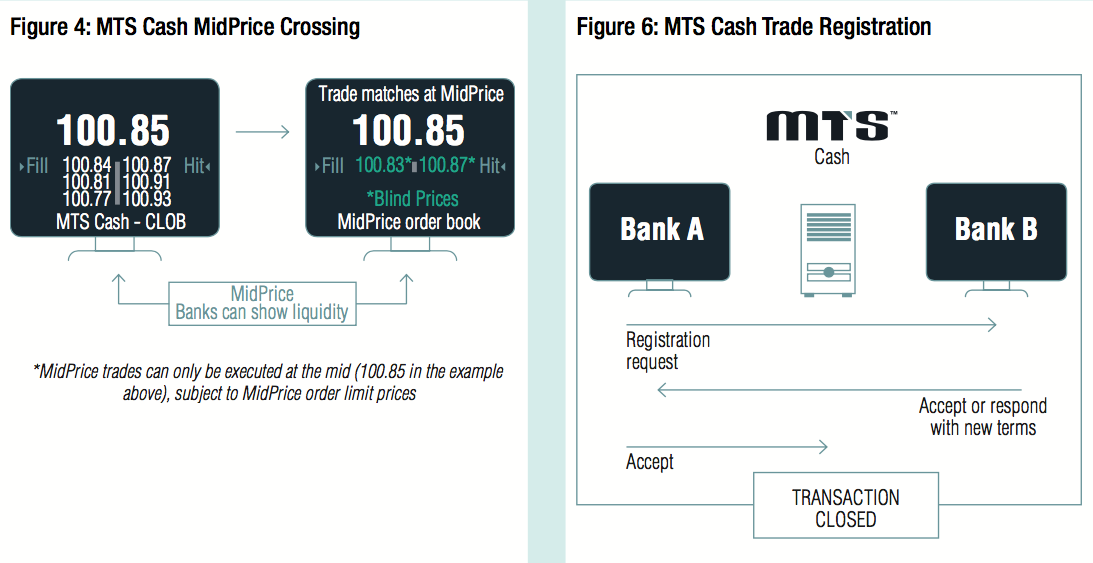

To allow market participants to work large orders more efficiently, rather than exposing their trading interest publicly, MTS provides a MidPrice Crossing functionality to complement the main Central Limit Order Book. The MidPrice order book works in parallel to the main order book, leveraging transparency waivers to allow for the submission of orders at pre-trade LIS to a semi-lit order book with no pre-trade disclosure of quantities or side. Orders are matched at the mid price calculated by the matching engine and protected by anti-gaming rules (see Fig 4).

Processed Trades

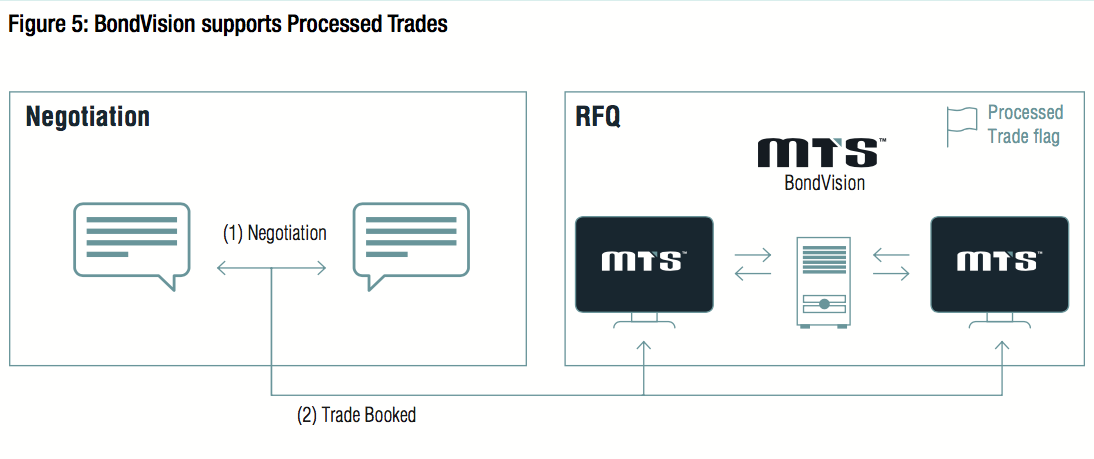

Given the complexity of the OTC trade reporting regime, MTS has enhanced its BondVision trading system to support Processed Trades (see Fig 5). This will enable market participants to book trades on BondVision which have been negotiated outside of the trading system and which benefit from a pre-trade transparency waiver.

In turn, MTS will manage the transparency for such trades and allow the counterparties to trade under the rules of a trading venue, while allowing the counterparties to benefit from MTS’s straight-through-processing.

Similarly, the MTS Cash Market Trade Registration functionality will provide this facility to the interdealer market (see Fig 6 above).

MTS: solving your MiFID II challenges

MiFID II will prove to be the most significant change to the regulation of European financial markets in living memory. As a leading operator of regulated electronic markets, MTS places a major emphasis on transparency and efficiency, which are two of the key themes that MiFID II is seeking to enhance.

MTS is ready to help you navigate the MiFID II world. Are you?

Contact: Tel: +44 20 7797 4090

Email: info@mtsmarkets.com

www.mtsmarkets.com

Tom Harry is the Regulatory Specialist in the Product team at MTS, focusing on MiFID II and other regulatory developments. Previously, Tom has worked at the London Stock Exchange and Borsa Italiana.

©TheDESK 2017

©Markets Media Europe 2025