Buy-side traders need to carefully manage order execution when a bond market moves into or out of an index, as the large directional moves which are triggered upend the normal range of trading costs, sizes and available liquidity. That affects a wider range of investors as the scale of exchange-traded funds (ETFs) in bond markets tracking indexes represented around US$2 trillion of assets under management in 2024, according to investment manager State Street Global Advisors (SSGA).

This year traders in the Qatari and Kuwaiti bond markets saw the impact of such an event, and consequently adapted their use of electronic trading to get better outcomes for their funds.

In February 2025, JP Morgan announced it would reclassify Qatar and Kuwait as developed markets, leading to their removal from its Emerging Market Bond Index (EMBI). Their removal is being phased over a 6-month period that started on 31 March 2025.

This reclassification may lead to Qatari and Kuwaiti bonds being classified differently across other indexes and on trading platforms. Any funds which track the index will be required to sell out of these positions to rebalance according to the new index composition.

This sell-off will be measured, given the nature of a single index reclassification, and therefore presents buy-side traders with an opportunity to optimize execution by taking advantage of forced sellers, or getting ahead of their own selling activity through a measured use of trading protocols that optimise for size, price or timing.

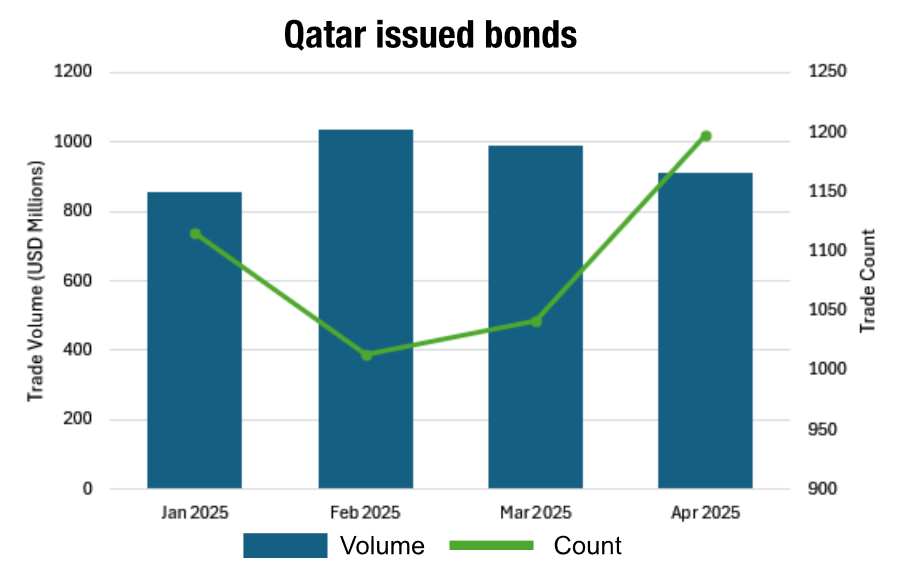

Looking at Qatari bonds, MarketAxess analysis indicates that in the first four months of the year, volume initially climbed following the announcement in February, while trade count fell, indicating that larger block trades were being executed in order to move positions.

This is confirmed in the number of Targeted Request For Quote (TRFQ) trades seen in Qatar over this period. Two hundred and fifty block trades (of US$3 million +) were executed on the platform in Q11.

Following the announcement, the pattern reversed, with trade count increasing and trade volume falling, indicating a higher volume of smaller, trades being used to achieve best execution.

While volumes reflect total activity, MarketAxess saw a slight uptick in the skew towards those wanting to sell on the platform since the beginning of the removal process, with Qatari bond traders showing a 56% skew towards enquiries to sell in Q1 up to 59% in April.

To mask directionality of enquiries – thereby reducing market impact – traders are using Open Trading (OT), MarketAxess’s all-to-all trading protocol, to find natural liquidity. OT has a 49% penetration of the Qatari market.

With a net volume of US$2.9 billion in Q1, trading in Qatari debt is the larger part of activity triggered by the reclassification.

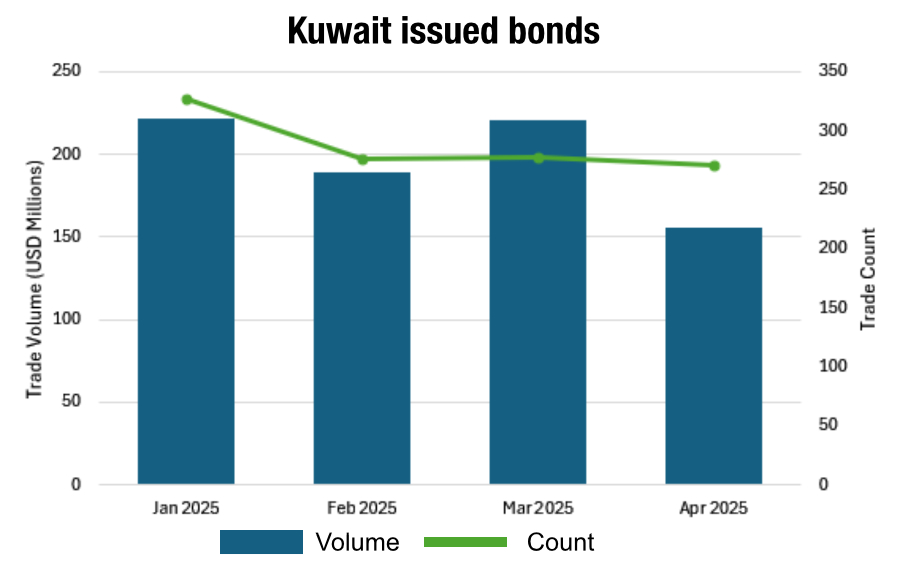

Looking at Kuwaiti market activity, which had a net volume of US$632 million in Q1, both volume and trade count gradually declined month-on-month over the first four months of the year, with a slight uptick on both in March after the removal process began. Kuwait saw a far greater directionality of selling with 66%, however with an enquiry volume of 44% selling on MarketAxess. This suggests a strong rate of matching enquiries to trades, which supports the thesis that the platform’s trading protocols were delivering better execution for traders during this period.

Looking ahead, the need to find buyers in a cost-effective and efficient manner can be greatly supported by use of electronic trading, and as indexation events continue in the EM space, is likely to continue to be a highly effective route for buy-side traders facing highly directional market activity.

Getting access to the best set of trading protocols, which can optimize trading against a range of parameters, sets up a desk to handle the impact of these big directional moves either as a buyer or seller in an indexation event.

1Block trades executed via Targeted RFQ trades allow buy-side trading desks to specify where to direct request for quotes in order to maximise the likelihood of finding a match to their order, by using pre-trade information to reach dealers actively making markets in the space.

©Markets Media Europe 2025