Case Study

Axess IQTM: The eyes and ears of the market

Over the past twelve months, MarketAxess in partnership with Insigneo rolled out a pilot program to put...

TradingScreen launches QUO web solution for dealer private bank and wealth management clients

QUO, the execution management and workflow system from TradingScreen (TS), the execution and order management platform provider, has launched a new web solution for...

Changing with the times

By Paul Reynolds, CEO of Bondcube

For a long time I have thought that the bond market shares many dynamics with the grocery industry. Large,...

ICE: Optimizing the data pipeline for buy-side trading desks

Buy-side bond traders can enhance execution through a flexible data offering.

The DESK spoke with Mark Heckert, ICE’s Chief Operating Officer of Fixed Income...

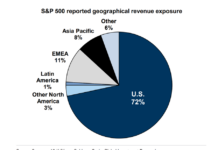

Insights and Analysis: Uncertainty reigns in trade war, rate impact expected

The inevitable effect of increased tariffs imposed by the US markets on trade partners – which may include the European Union, Canada and Mexico...

Parameta Solutions becomes an authorised benchmark administrator

Parameta Solutions, the Data & Analytics division of TP ICAP, has become a Financial Conduct Authority (FCA) authorised benchmark administrator, which it claims makes...

Ending technology asymmetry in primary markets for bonds

By Rahul Kambli, Senior Product Owner, Genesis Global.

Accessing the primary market for corporate bonds can be lucrative for asset managers astute about pricing and...

Tradeweb and CFETS launch southbound Bond Connect channel

Market operator Tradeweb Markets is expanding its trading link with China Foreign Exchange Trade System (CFETS) under the Bond Connect channel on 24 September...

Tradeweb announces JSCC clearing for MTF and SEF Yen swaps

Multi-asset market operator, Tradeweb has reported that institutional clients executing Japanese Yen swaps on its multilateral trading facilities (MTFs) and swap execution facilities (SEFs)...

Intercontinental Exchange agrees to acquire TMC Bonds

Intercontinental Exchange (ICE), a leading operator of global exchanges and clearing houses and provider of data and listings services, announced on 29th May that it...

Linedata : Managing operations to thrive in 2021

By Ed Gouldstone, Global Head of Research & Development, Linedata Asset Management.

The word unprecedented may have been overused in 2020, but there is no...

Four drivers of Brazil’s increasingly complex corporate credit market

The Brazilian corporate credit market is becoming increasingly complex, and active bottom-up selection is essential for identifying winners and losers in this shifting environment.

That’s...