Cboe Australia, XTB expand access to corporate bond products

Cboe Australia has added XTB’s exchange-traded corporate bond products (XTBs) to the Cboe Funds platform.

In partnership with XTB, Cboe Australia has launched a series...

FILS 2022: Deferral times priority for consolidated tape plans – EC’s Lueder

Plans for a consolidated tape for fixed income markets in Europe hinge on the “urgent priority” of harmonising post-trade publication windows – keeping them...

APG selects FlexTrade for multi-asset execution

APG Asset Management (APG) has selected FlexTrade’s execution management platform, FlexTRADER EMS, to consolidate and streamline its multi-asset execution management capabilities.

APG, headquartered in the...

ICE: Optimizing the data pipeline for buy-side trading desks

Buy-side bond traders can enhance execution through a flexible data offering.

The DESK spoke with Mark Heckert, ICE’s Chief Operating Officer of Fixed Income...

Trading desk efficiency benchmark 2016

This primary research offers traders a view of trading operations within their peer group, to benchmark against their own.

This research is a snapshot of...

Citadel Securities making markets in Treasuries on Tradeweb

By Dan Barnes.

Citadel Securities has become a liquidity provider on the Tradeweb institutional US Treasury marketplace, for dealer-to-client trading. Citadel Securities’ expansion into Tradeweb’s...

US Treasuries: Coalition Greenwich update on falling interdealer volume and BIS warning

US markets have had an eventful summer according to analysis by Coalition Greenwich, which saw an average daily notional volume (ADNV) for US Treasuries...

Aquis selected for Central Bank of Colombia government bond market

Banco de la República, the Central Bank of Colombia, has selected Aquis Exchange to provide technology and support services for Sistema Electrónico de Negociación...

Aparajita Dalal: Derivative Exchange Notifications

At a moment’s notice

Tracking exchange notifications that affect listed derivatives reference data is laborious. Overlooking notices is easily done and can be costly. Aparajita...

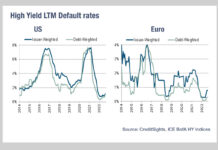

Less distressed debt

The risks of default in high yield credit are one reason cited for reduced sell-side trading activity in the asset class. However, while the...

Margin calls for bitcoin futures pose systemic threat

AIG failed in 2008, because the value it placed upon the mortgages underpinning the credit default swaps it had sold to Goldman Sachs was...

MiFID II are you ready for 2018?

With the introduction of MiFID II and MiFIR on 3 January 2018, the European financial markets will face the biggest regulatory change they have...