MarketAxess rolls out open trading for local currency bonds

MarketAxess has built out its open trading offering with the launch of open trading for local currency bonds. The first tranche of local currency...

Viewpoint: Establishing a clear path forward

Tim Whipman from TransFICC provides an update on the consolidated tape for European fixed income, and explains the key requirements, hot topics and technology...

Parameta Solutions launches post-trade analytics platform for bonds

Parameta Solutions, the brand of TP ICAP’s Data & Analytics division, has launched a global post-trade analytics platform, Trading Analytics. The new offering is...

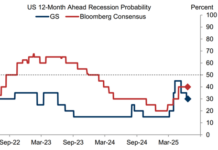

Insights and analysis: Goldman cuts US recession probability to 30%

In a research piece from 21 June, Goldman Sachs economist Jan Hatzius provides an improved outlook on US economic conditions as tariffs expectations stabilised....

Investors flock to credit futures amid credit spread concerns

CME Group has reported a sharp increase in credit futures contracts, noting nine consecutive days of increases in active, unsettled contracts.

The US credit futures...

IOSCO sets pre-hedging guard rails, amid calls for ban

The International Organisation of Securities Commissions (IOSCO), has published its final report on pre-hedging, amid call for the practice to be banned, and allegations...

Markets Media Group acquires DerivSource

New York & London, October 5, 2021 – Leading U.S.-based digital financial news publisher Markets Media Group (MMG) is pleased to announce the acquisition of DerivSource, the...

Thailand’s Government Pension Fund taps Charles River for front office management

Thailand’s government pension fund has selected State Street subsidiary Charles River Development to modernise its front office operations and manage its domestic and international...

First trade of a fractionalised blockchain-based bond announced

Northern Trust and Singapore start-up BondEvalue, which formed a strategic partnership last November, announced the completion of the first trade of a fractionalised blockchain-based...

InvestorAccess reaches milestone with 500th institutional investor on board

IHS Markit reports it has onboarded the 500th institutional investor to its buy-side InvestorAccess community, the firm’s digital primary market platform.

InvestorAccess first launched in...

Bond Origination Technologies set to launch early 2021

Bond Origination Technologies (Bots), a London-based financial technology start-up for the primary debt capital markets (DCM), has completed its latest fundraising round, formed its...

Bowles joins Vanguard in European expansion

Nick Bowles has joined Vanguard as an active high-yield trader as the firm seeks to build out its actively managed European high-yield and leveraged...