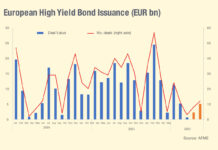

AFME update: European HY bond issuance fell nearly 60% year-on-year

A new report by AFME found that the primary high yield bond market decelerated significantly in Europe at the start of this year.

High yield...

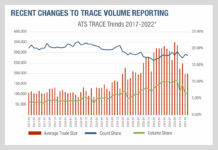

What FINRA’s trade reporting changes tell us about consolidated tapes

Understanding the difference between commercial and public data offerings is crucial for data users. A good example of this difference can be found with...

European Women in Finance: Isabelle Girolami – A fresh attitude to risk

Isabelle Girolami has been CEO of LCH Ltd. since 1 November 2019. She has since had to deal with a global pandemic requiring employees...

Lutnick on FMX vs CME: “Put us toe-to-toe in the ring and we’re on.”

Interdealer brokers and market operator BGC Group intends to launch its futures exchange for US Treasury and SOFR contracts this summer to compete with...

Jefferies: Fixed income ETFs drive transformation of the market

The impact of exchange-traded funds (ETFs) on the fixed income market cannot be overstated, agreed speakers at Jefferies’ ‘New Investing Frontiers – Explore the...

FICC marks new GSD daily activity record of US$9.2 trillion

The Government Securities Division (GSD) of the Depository Trust & Clearing Corporation’s (DTCC) Fixed Income Clearing Corporation (FICC) cleared US$9.2 trillion in daily activity...

Will liquidity shifts bend or break US Treasuries?

Disclosed trading and internalisation are increasing as liquidity is wrung out of dealers and electronic market-makers. Chris Hall reports.

As January’s storms ripped holes in...

ASIC fines ANZ record AUD 240mn over “grubby” unconscionable conduct

Australia and New Zealand Banking Group (ANZ) has once again been fined by the Australian Securities and Investments Commission (ASIC). The regulator has set...

FILS USA 2022: Market structure under microscope

There are a host of regulatory proposals out there that stand to have a material and practical impact on how fixed income markets operate,...

VIDEO: End to End CSDR Processing – Roles, Responsibilities, and Issues for all Participants

On 22nd July, 2020 a panel of market participants discussed the detailed implications of the Central Securities Depository Regulation (CSDR).

The panel comprised, J.R. Bogan,...

GreySpark: FI markets will continue to see fragmentation based on all-to-all trading

A report by consultancy GreySpark has found that in 2020, global fixed income e-trading landscape has been defined by fragmentation in line with historical...

How to secure balance sheet from your broker

Buy- and sell-side veterans tell us the best practices which persuade brokers to take risk on their clients’ behalf.

Finding sell-side partners to take the...