Citi bolsters Australian, New Zealand markets business with seven appointments

Citi Australia and New Zealand’s Markets business has expanded its team with seven appointments across markets sales, asset-backed securitisation and financing, G10 rates trading,...

April Day leads AFME capital markets

AFME has named April Day as head of capital markets.

Based in London, she replaces Rick Watson, who announced his retirement in July 2024.

Day has...

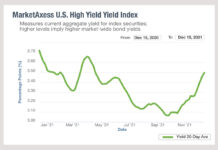

Analysis of US yields in 2021 and anticipation for next year

Yields for US high yield bonds have turned a corner, according to MarketAxess data, following a drop from 3.65% in April down to 3.065%...

Five ideas from FILS for buy-side traders

The Fixed Income Leaders’ Summit US kicked off on Monday 9 June in Washington DC, with the buy-side traders’ day. While no reporting is...

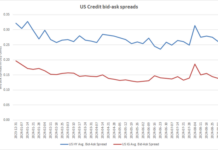

Falling costs of liquidity not halted by summer vol

The bid-ask spread for corporate bond markets has continued on a downward trajectory in September, after a bump in August, according to data from...

Trumid upgrades US corporate bond predictive pricing tool

Trumid launches its enhanced Fair Value Model Price (FVMP) tool, which aims to deliver predictive pricing for around 22,000 US corporate bonds every 30...

Amit Raja takes new role at Citi

Citigroup has confirmed that Amit Raja has been appointed regional head of markets for EMEA at the investment bank.

The announcement follows Leo Arduini’s appointment...

Will liquidity shifts bend or break US Treasuries?

Disclosed trading and internalisation are increasing as liquidity is wrung out of dealers and electronic market-makers. Chris Hall reports.

As January’s storms ripped holes in...

EC suspends best execution reporting which is “not read at all”

The European Commission (EC) has adopted a Capital Markets Recovery Package, as part of the Commission's overall coronavirus recovery strategy which includes increased leniency...

Digital Asset’s new markets blockchain backed by CBOE, Deutsche Börse and ASX

Digital Asset and a group of capital market participants plan to launch the Canton Network, a ‘privacy-enabled’ interoperable blockchain network designed for institutional assets....

Viewpoint: The impact of regulation: Tim Keady

Rearchitecting your compliance framework.

Tim Keady, Managing Director, Head of DTCC Solutions and Chief Client Officer at DTCC.

Since the 2008 financial crisis the industry has confronted numerous waves...

Are your traders for hire?

Growing numbers of asset managers are hiring third parties to provide their trading desks. Dan Barnes investigates.

Fixed income funds are under increasing pressure to...