Versana to launch syndicated loan platform

Fintech firm Versana is to launch a syndicated loan platform, joining together banks, institutional lenders and their service providers in an effort to bring...

Jim Leaviss leaves industry, Andrew Chorlton joins M&G Investments

Jim Leaviss, chief investment officer for M&G Investments’ fixed income division, is leaving the firm. He is replaced by Andrew Chorlton, currently head of...

SSGA launches new bond ETF on Barclays Global Aggregate index

State Street Global Advisors (SSGA) has launched the SPDR Barclays Global Aggregate UCITS exchange traded fund (ETF). The fund is available unhedged on the...

Liquidnet adds trading in the South African bond market

Block and agency trading specialist Liquidnet, a TP ICAP company, is partnering with TP ICAP South Africa to support bond trading.

The firm reports...

Could OpenFin be as big as Bloomberg?

Connectivity between technologies and between trading participants is a perennial problem for bond trading desks. Hooking up with a new trading platform or service...

Mizuho EMEA joins Neptune to distribute real-time axe data

Mizuho EMEA has joined Neptune Networks, the fixed income network for disseminating real-time axe data.

Neptune delivers axes from 32 of the leading dealers...

Tradeweb’s annual client letter – in full

The annual letter to clients from Tradeweb’s CEO and chair, Lee Olesky, and president and CEO-elect, Billy Hult, has been published, noting the tough...

Argentina’s battle for control

Argentina’s bond markets have been notoriously challenging for investors. Twenty years after the country underwent a major debt restructuring, and just five years after...

IHS Markit and CBPC open up China’s bond market with new onshore indices

By Shobha Prabhu-Naik.

Business information provider IHS Markit has launched new onshore Chinese bond market indices, which it claims are the first international, independent fixed...

How asset managers capture micro-alpha opportunities

Setting up your desk correctly can help to boost returns for funds and clients.

When an opportunity arises for a fund to improve its returns,...

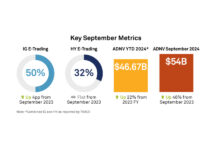

September: US corporate bond ADNV hits $54bn, up 46% YoY

The average daily notional volume (ADNV) for US corporate bonds hit a new high of US$54 billion in September 2024, a 46% increase compared...

This Week: Chris Collins, Lazard Asset Management

Lazard Asset Management: ‘European Trading Clock Needs Renewed Scrutiny’

As a massive portion of European trading takes place after US markets open, Chris Collins, equity...