Liberty Street Economics: Active trading could drive loan standardisation

By Flora McFarlane.

A Liberty Street Economics report analysing the US secondary loan market has found that increased trading and liquidity will potentially standardise loans.

The...

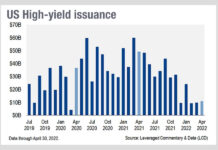

How does the collapse of refinancing affect bond trading?

It costs more to borrow money in the US right now, than it has for a long time. Even more so for companies in...

European HY bond issuance saw 45% increase in 2023

High yield bond issuance reached €66 billion in 2023, up from €45 billion in 2022 which had been a record low.

The findings come...

Research Profile: DirectBooks

The electronification of primary bond markets is a priority for buy-side firms this year, and DirectBooks, originally formed by a consortium of nine global...

Subscriber

FILS USA 2022: Market structure under microscope

There are a host of regulatory proposals out there that stand to have a material and practical impact on how fixed income markets operate,...

Intercontinental Exchange makes strategic investment in BondLink

Market operator and data provider InterContinental Exchange (ICE) has made a strategic investment in BondLink, a financial technology company that provides cloud-based debt management...

TransFICC opens office in New York

TransFICC, the provider of low-latency connectivity and workflow services for fixed income and derivatives markets, has opened its new office in New York, staffed...

SIFMA finds support for shift in benchmarking of 20-year US corporate bonds

The spread for many legacy 20-year US corporate bonds is benchmarked against the 30-year Treasury, but trade body SIFMA has found support for moving...

Liquidnet boosts workflow through Boltzbit AI partnership

Liquidnet has partnered with Gen-AI startup Boltzbit to enhance its fixed income primary markets workflow using a custom AI model, allowing the firm to...

Neptune embeds Symphony chat functionality

Neptune Networks Ltd, the Fixed Income network for real-time “axe” indications, today announced that it has embedded Symphony chat functionality within the Neptune proprietary...

CME, DTCC boost cross-margining services

DTCC and CME Group have expanded their cross-margining initiative for clients of CME and the Government Securities Division (GSD) of DTCC's Fixed Income Clearing...

MarketAxess launches centralised marketplace with integrated rates trading

Electronic bond market operator, MarketAxess, has launched a centralised fixed income trading marketplace integrating rates trading capabilities within the MarketAxess trading system.

MarketAxess acquired government...