The 2020 vision for primary markets

New platform launches in 2020 will see intense competition to manage the bond issuance process. Dan Barnes reports.

Traders at buy-side firms are looking for...

‘HUB’ approach to buy-side middle and back office unites rivals

A new technology-led company, HUB, is being formed to build a cloud-based operating platform aimed at transforming asset managers’ operations technology.

The firm is being...

Bank of England warns of risks in fast fixed income markets

By TheDESK

Chris Salmon, executive director for markets at the Bank of England has warned that risk management techniques need to develop to handle the...

US corporate bond market growth continues upward trend in July

The US corporate bond market in July saw increases across nearly all the metrics tracked by Coalition Greenwich, with average daily notional volume (ADNV)...

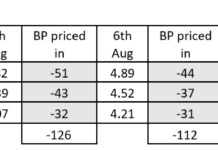

Tradeweb data reveals shock of rate cut expectations on swaps market

Analysis of Tradeweb data has show the level of surprise at potential central bank rate cuts over the past week in the interest rate...

FILS 2021: The five big questions at FILS this year

1. When will we see a functional consolidated tape?

Market structural discussions at FILS will naturally take in European Commission’s plans for the proposed consolidated...

Clearstream consortium seeks to resolve historic Reg S and Rule 144A bond inefficiencies

In October, the international central securities depositary (ICSD), Clearstream, has its seventh meeting of its business consortium to reduce operational risks and time delays...

CME reports record SOFR futures volume and open interest

Market operator and infrastructure provider, CME Group, has reported that a record 396,421 SOFR futures contracts were traded on 18 October 2021, surpassing the...

On the Desk: David Walker – Trading with your feet on the ground

David Walker, head of fixed income trading at M&G Investments, discusses no-ego trading, the importance of direct contact with markets, and strong banks relationships.

How...

This Week from Trader TV: Laura Cooper, Nuveen

Nuveen: Navigating private credit shocks and the Fed rate cycle

Private credit markets are showing signs of strain, but risks remain largely contained, says Nuveen,...

UPDATE: Fed to end supplementary leverage ratio, talks down tapering

The federal bank regulatory agencies today announced that the temporary change to the supplementary leverage ratio, or SLR, for depository institutions issued on 2020,...

How the Trumid takeover will affect Electronifie traders

All-to-all US bond trading platform Trumid has agreed to buy fellow all-to-all trading platform Electronifie. Upon closing, the deal will mean the Trumid user...