Abel Noser acquires Trade Informatics

Trade analytics and agency brokerage Abel Noser has closed the deal with Trade Informatics, a New York based firm offering equities trade cost analysis...

Bond Origination Technologies set to launch early 2021

Bond Origination Technologies (Bots), a London-based financial technology start-up for the primary debt capital markets (DCM), has completed its latest fundraising round, formed its...

What is crushing the bid-ask spread in US IG?

The bid-ask spread in US investment grade credit has been falling this year, regardless of the trading volume activity.

Notional traded in the US...

Thailand’s Government Pension Fund taps Charles River for front office management

Thailand’s government pension fund has selected State Street subsidiary Charles River Development to modernise its front office operations and manage its domestic and international...

Plenary: Tips to be the best trading desk

A sophisticated analysis of trading impact, total cost and the market ecosystem is imperative to the success of a buy-side fixed income trading desk, said...

SEC classifies HFT liquidity providers as “dealers”

US markets regulator, the Securities and Exchange Commission (SEC), has adopted two rules that require market participants who engage in certain dealer roles, in...

On the DESK : Lee Sanders, AXA Investment Managers

Lee Sanders, head of Head of Execution at AXA Investment Managers believes that increasing automation is the biggest issue on buy-side trading desks.

How has...

Broadridge preempts trader demands with BondGPT update

Broadridge has updated BondGPT to anticipate user queries and provide market data and insights based on their progression through the investment and trading workflow.

Through...

Rules & Ratings: S&P’s APAC sovereign ratings stable – for now

No changes were made to S&P Global’s 21 APAC sovereign ratings or outlooks in H1 2025, suggesting an expectation that the global economy will...

Sovereigns may be downgraded due to climate change

There could be a significant economic impact on the 25 countries in the FTSE World Government Bond Index (WGBI) by 2030 due to the...

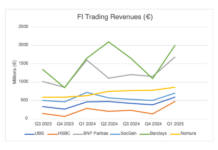

Barclays bounces with strong Q1 trading revenues

Fixed income trading revenues spiked in the first three months of the year at Barclays, putting the bank significantly ahead of the majority with...

RBC Capital Markets launches Aiden Arrival algorithm

RBC Capital Markets has launched Aiden Arrival, the second algorithm on the firm’s artificial intelligence (AI) -based electronic trading platform. Aiden Arrival follows the Aiden...