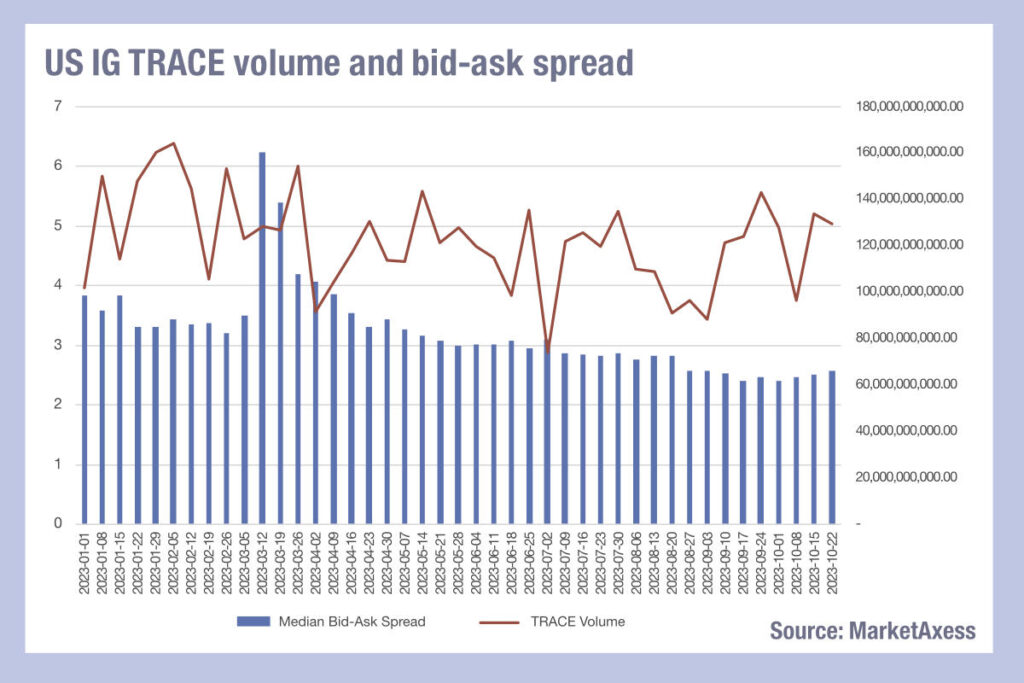

The bid-ask spread in US investment grade credit has been falling this year, regardless of the trading volume activity.

Notional traded in the US market has bounced around like a sales trader pitching a junior portfolio manager, but the cost of liquidity has continued to fall, according to data from MarketAxess’s CP+ and TRACE.

Sensibly, we should consider the investibility of the IG asset class. Interest rates are up and so yields are up, pushing down the price of outstanding bonds in the secondary market. The falling cost of bonds might require banks to tighten the bid-ask spread in order to sell them. However, one would also expect the volume of trading to have declined and that does not appear to be the case. Another possible explanation could be that dealers are trading more efficiently, allowing them to quote tighter spreads.

We have seen average trade sizes falling, corresponding with an increase in all-to-all trading, portfolio trading, streamed prices and more automated execution which reflect an increased capacity to supply liquidity at a lower cost. A third and final explanation would be increased competition, which could be driving down the bid-ask spread as dealers and electronic market makers compete to win business.

This is definitely taking place, and with Citadel entering the US credit market in Q3 is certainly a changing dynamic. The second and third points are closely interlinked, and in all likelihood it is both that are creating downward pressure. In an investment environment which is more positively geared towards fixed income assets, it is surely positive for the buy side to see such a drop off in the costs of trading.

It will also be key for trading desks to ensure they can benchmark their own trading costs against the wider market to strive for better execution against their peers.

©Markets Media Europe 2023