The data puzzle

Umberto Menconi, head of Digital Markets Structure, Market Hub at Banca IMI outlines the impact of regulation and the importance of data in a...

InvestorAccess reaches milestone with 500th institutional investor on board

IHS Markit reports it has onboarded the 500th institutional investor to its buy-side InvestorAccess community, the firm’s digital primary market platform.

InvestorAccess first launched in...

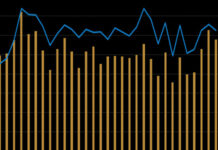

Get US high yield portfolios in order over summer

June looked decidedly challenging for US high yield (HY) trading, as mean bid-ask (BA) spreads dislocated from the median, indicating spikes in BA spreads...

TransFICC launches RFQ negotiation workflow automation tool

Low-latency connectivity and workflow services provider TransFICC has launched request for quote (RFQ) negation workflow automation platform TransACT.

Designed for banks trading on dealer-to-client (D2C)...

PBI integrates 7 Chord’s BondDroid fixed income pricing

PBI has integrated 7 Chord’s near real-time, delayed, and end-of-day bond prices for corporate, sovereign and government bonds within its investment management systems, which...

Gain greater confidence in your automated trading decisions during market volatility

Charlie Campbell-Johnston, Managing Director, AiEX & Workflow Solutions at Tradeweb.

In times of volatility, traders need to react quickly to tricky market conditions – and automation...

Quantum leap: HSBC, IBM improve bond RFQ fill rate by 34%

HSBC and IBM have reported a 34% improvement in fill-rate modelling for bond request-for-quote (RFQ) using quantum-generated features and common data science algorithms.

The bank–technology...

ASEAN exchanges push for sustainability progress

Executives at ASEAN exchanges have agreed on four proof-of-concepts to follow over the next three years, continuing their sustainability initiatives.

The objectives, determined at the...

Davis Polk boosts asset management investment with three new partners

Davis Polk has hired Andrew Ahern, Alisa Waxman and Luke Eldridge as partners in the investment management practice in New York.

Ahern advises sponsors of...

ADDX launches blockchain-based debt issuance marketplace

Private market exchange ADDX has launched a blockchain-based multi-issuer debt issuance solution for firms to issue digitised commercial paper and bonds.

The digitised bonds from...

Trade munis like a champion.

To kickoff Muni Madness, MarketAxess are unveiling their latest White Paper that details the methodology behind this revolutionary pricing tool that brings transparency to...

FILS 2021: Natural attrition should drive new ways to trade

Old ways of working must be ‘allowed to die’ to make way for blockchain and distributed ledger technology (DLT), delegates at day two of...