Charles River Development to be acquired by State Street Corporation

Charles River Development, provider of the Charles River Investment Management Solution (IMS), will be acquired by State Street Corporation, a deal expected to be...

Bitfinex Securities and Mikro Kapital launch ongoing tokenised bond issue

Bitfinex Securities, which offers listing and trading services for security tokens, has launched two new tokenised bond issues under an ongoing tokenised bond issuance...

Johnson Chui to lead HKEX global issuer services

Hong Kong Exchanges and Clearing Limited (HKEX) has appointed Johnson Chui as managing director and head of global issuer services, effective 2nd September.

In the...

ESMA moves to tighten up algo surveillance

Algo trading has grown increasingly complex over the last decade. In 2007, the Markets in Financial Instruments Directive (MiFID) permitted competition with the national...

Rates : Trading protocols : Dan Barnes

The new Treasuries protocols

Breaking away from the request-for-quote protocol could allow for tighter pricing without information leakage.

Traders engaged in the US Treasury (UST) markets...

Hunstad and Roth take investment reins at NTAM

Northern Trust Asset Management (NTAM) has named Michael Hunstad and Christian Roth global co-chief investment officers, effective 1 June.

They replace Angelo Manioudakis, who has...

Brokertec data shifts to Bloomberg with Reuters/Dealerweb data tie-up

By Shobha Prabhu Naik & Dan Barnes.

Bloomberg, the financial data provider, has launched a new data service that will take NEX’s BrokerTec US Treasuries...

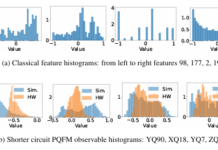

Quantum computing ‘breakthrough’ has “more red flags than a People’s Liberation Army parade”

The claim by HSBC that noise in an IBM quantum computer helped deliver a 34% improvement in algorithmic trading performance has been disputed by...

Algomi/Euroclear deal may open access to 373,000 bonds

Pre-trade data provider Algomi has significantly extended the universe of bonds for which it can publish trading opportunities, by signing a new agreement with...

NBIM names global co-heads of fixed income trading

Norges Bank Investment Management (NBIM) has appointed Pauli Mortenson and John Sullivan as global co-heads of fixed income trading, following the promotion of Malin...

IOSCO sets pre-hedging guard rails, amid calls for ban

The International Organisation of Securities Commissions (IOSCO), has published its final report on pre-hedging, amid call for the practice to be banned, and allegations...

Technology: Educating data

Can better pre-trade data really unlock liquidity in frozen fixed income markets?

If buy and sell-side bond traders are to see real benefits from the...