Gain greater confidence in your automated trading decisions during market volatility

Charlie Campbell-Johnston, Managing Director, AiEX & Workflow Solutions at Tradeweb.

In times of volatility, traders need to react quickly to tricky market conditions – and automation...

Rules & Ratings: FTSE Russell launches Fixed Income TPI Index and TPI Focused Glidepath...

FTSE Russell has rolled out two new indices – the FTSE Fixed Income TPI Climate Transition Index Series and the FTSE Fixed Income TPI...

Ediphy launches automated bond liquidity discovery tool

Fixed income technology provider Ediphy has launched a tool, Liquidity Checker, which allows fixed income market participants to automate the monitoring of bond liquidity....

Global Investor Confidence Index decreased in February by 8.9 points

The Global Investor Confidence Index (ICI) decreased to 91.9, down 8.9 points from January’s revised reading of 100.8. The decline in investor confidence was...

How to trade for alpha

Smart institutional trading desks can boost returns in support of investment management. Dan Barnes reports.

If institutional portfolio management (PM) and investment trading were separated in...

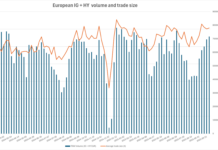

European credit trades size up 15% year on year Q3

European credit trades keep getting larger. The notional blended trade size for Investment grade and high yield European credit was €786k in September 2025...

New ECB harmonisation rules push for capital markets union

The European Central Bank (ECB) has published harmonised rules and arrangements for the mobilisation and management of collateral in Eurosystem credit operations in its...

Seth Bernstein: Diversification via fixed income “if not dead, is in critical condition”

Seth Bernstein, the CEO of US$622 billion AUM asset manager AllianceBernstein, has opened the Fixed Income Leaders’ Summit US today, with an analysis of...

Tradeweb in discussions to acquire Australian bond trading platform Yieldbroker

Tradeweb Markets, multi-asset market operator has said, “Tradeweb is in advanced discussions to acquire Yieldbroker, a leading Australian government bond and interest rate derivatives...

Quant funds assess the value of trading

There are huge variations in investment and trading activity across quantitative strategies, the Fixed Income Leaders Summit heard in Amsterdam on Wednesday, and the...

BondAuction and NowCM partner to support primary market access

BondAuction and NowCM, the primary market platform, are establishing connectivity between their platforms to offer connectivity for respective clients and users.

NowCM and BondAuction will...

Citi develops blockchain FX solution under Monetary Authority of Singapore Guardian project

Citi has developed an application that uses blockchain infrastructure to price and execute bilateral spot foreign-exchange (FX) trades.

The application is a part of Project...