QUODD and S&P GMI expand partnership with data solution

Market data-on-demand provider QUODD has added bond data from S&P Global Market Intelligence into its back-office platform, QX Digital.

QX Digital provides a user-specific experience,...

Flextrade deployed at Mirae Asset Securities US operations

Mirae Asset Securities (USA) has selected FlexTrade Systems’ ColorPalette Order and Execution Management System (OEMS). The move is designed to support the firm’s overnight...

Behavox snaps up Mosaic for transaction data insights

Data services provider Behavox has acquired Mosaic Smart Data as it prepares to release a trade surveillance product.

Mosaic aggregates internal and external transaction data...

MeTheMoneyShow – Episode 10

Dan Barnes and Lynn Strongin Dodds discuss reports from the week past, ranging from how asset managers need to re-think their operating models to...

BondDroid AI now available within TS Imagine’s TradeSmart fixed income EMS

TS Imagine has made 7 Chord’s BondDroid AI available within the TradeSmart fixed income EMS.

BondDroid AI applies real-time continuous learning technology to generate accurate...

European credit volumes plummet as US stays buoyant

European corporate bond markets have seen trading volumes and trade count collapse going into summer, as the holiday period provides some respite for tired...

Ipreo positive on FCA primary market consultation

By Flora McFarlane.

Primary market platform provider Ipreo has welcomed the consultation on primary markets by UK market regulator the Financial Conduct Authority (FCA).

“The FCA’s...

JP Morgan restricted from onboarding new venues and fined US$350 million

JP Morgan has been fined US$350 million and may not onboard new trading venues without receiving prior written non-objection from the Federal Reserve Bank...

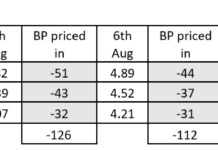

Tradeweb data reveals shock of rate cut expectations on swaps market

Analysis of Tradeweb data has show the level of surprise at potential central bank rate cuts over the past week in the interest rate...

Quantitative Brokers: Rate futures market susceptible to shocks

A new paper by Quantitative Brokers’ research team, led by Shankar Narayanan has found that the average quote size of many interest rate futures...

Union Investment imposes a purchase ban on Russian state bonds and sanctioned companies

Union Investment has decided to impose an immediate ban on the purchase of all securities of the Russian state and a number of Russian...

EUREX: Why credit index futures are here to stay

Lee Bartholomew, global head of fixed income and currencies product design, and Davide Masi, fixed income ETD product design at Eurex spoke to The DESK...